GATEX: A Sectorial Portfolio Breakdown

The Gateway Fund – Class A (GATEX) seeks to attain capital appreciation through its equity market investments. It has less risk compared to equity markets.

Nov. 20 2020, Updated 1:23 p.m. ET

Short call, long put

The Gateway Fund – Class A (GATEX) seeks to attain capital appreciation through its equity market investments. It has less risk compared to equity markets. For reducing its overall portfolio risk, GATEX makes extensive use of option derivative contracts. The writer of a call option and purchaser of a put option are always bearish in the market. As a result, the option portion of the portfolio will only profit if the market value of the respective indexes falls after the contracts have been made. In the case of call options for the fund, the maximum profit is the total premium received. In the case of put options, the maximum profit is the difference between the current value of the index and the exercise value after deducting the premium. According to GATEX’s prospectus, “The fund may not spend at any time more than 5% of its assets to purchase index put options.”

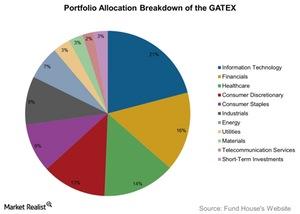

The above chart gives the sectoral portfolio breakdown of GATEX at the end of September 2015.

Portfolio breakdown

The fund was managing total net assets of $8.3 billion as of December 31, 2015. It mainly invested across the IT, financials, and healthcare sectors. At the end of November, the fund’s top five equity holdings were Apple (AAPL), Microsoft (MSFT), ExxonMobil (XOM), General Electric (GE), and Wells Fargo (WFC).

The fund’s total portfolio is divided among common stocks, short index calls, and long put calls. Also, the fund can invest in foreign securities traded in US markets—like ADRs (American depositary receipts). The fund can enter into repurchase agreements. It can hold cash and cash equivalents.

In the next part, we’ll analyze the impact of adding GATEX to a portfolio of the S&P 500 Index (VFINX).