Crude Oil Prices Rally Due to Short Covering

WTI (West Texas Intermediate) crude oil futures contracts for January delivery rose slightly by 0.4% and closed at $43.04 per barrel on Wednesday.

Nov. 20 2020, Updated 5:24 p.m. ET

Crude oil prices rally

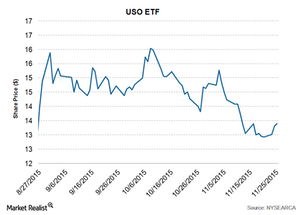

WTI (West Texas Intermediate) crude oil futures contracts for January delivery rose slightly by 0.4% and closed at $43.04 per barrel on Wednesday, November 25, 2015. Prices rose for the third consecutive day due to short covering and a less-than-expected inventory increase. US crude oil–tracking ETFs United States Oil Fund (USO) and the ProShares Ultra DJ-UBS Crude Oil ETF (UCO) followed the direction of US crude oil prices. They rose by 0.53% and 1%, respectively, in yesterday’s trading.

Inventory

The EIA (U.S. Energy Information Administration) released its weekly petroleum status report on November 25, 2015. Government data reported that US commercial crude oil inventories rose by 1 MMbbls (million barrels) for the week ending November 20, 2015. Likewise, the API (American Petroleum Institute) reported that crude oil stockpiles rose by 2.6 MMbbls for the same period. Reuter’s surveys projected that crude oil stockpiles could rise by 1.2 MMbbls for the same period. The less-than-expected inventory increase supported crude oil prices. Read the next part of this series to learn more about inventories.

The increase in crude oil prices benefits US oil producers like Exxon (XOM), Chevron (CVX), Occidental Petroleum (OXY) and Hess (HES). In contrast, it negatively affects US refiners like Tesoro (TSO) and Valero (VLO).

Short covering

Prices have shorted up more than 7% for the week due to geopolitical tensions between Russia and Syria. The consensus of supply disruptions led to the crude oil rally. The crude oil market has been under long-term oversupply concerns, so many traders and hedge funds are net short on the oil market. Traders covered their short on Wednesday, November 25. The US market is closed today, on Thursday, November 26, for Thanksgiving. Rising tensions between Russia and Syria could play a vital role in driving oil prices due to uncertainty during the holidays. So traders might have covered their shorts ahead of the holiday.

Volatility analysis

S&P GSCI Commodity Index-tracking 24 commodities fell by 18.5% YTD (year-to-date). Likewise, US benchmark WTI crude oil prices fell 18.8% YTD. The global benchmark Brent crude oil prices also fell 19.3% YTD. Commodities fell due to oversupply and weak demand consensus from China. The uncertainty in oil and gas prices also affects ETFs such as the iShares US Oil Equipment & Services ETF (IEZ) and the Fidelity MSCI Energy Index (FENY).

In this series, we’ll look at crude oil prices and fundamentals. For an in-depth fundamental look at the oil and gas sector, visit Market Realist’s Energy and Power page.