Overview of BioMarin: History and Product Portfolio

Here we present an overview of BioMarin. It’s based in California and was founded in 1997. It focuses on therapies for life-threatening rare genetic diseases.

Nov. 20 2020, Updated 2:03 p.m. ET

Company overview

BioMarin (BMRN) is based in San Rafael, California, and was founded in 1997. It focuses on therapies for life-threatening rare genetic diseases, concentrating on new treatments for small population groups.

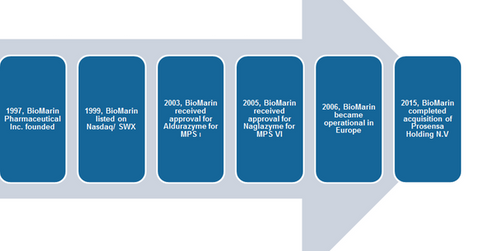

History

BioMarin was founded by Christopher Starr and Grant W. Denison Jr. with an initial investment of $1.5 million that came from Glyko Biomedical Ltd. The company was further successful in raising $11.3 million from private investors in the same year.

The company started a clinical trial for Aldurazyme, its first drug, for the indication of mucopolysaccharidosis I (or MPS I) in 1997. During 1999, BioMarin was listed on the NASDAQ stock exchange. Later, in 2003, it received approval for commercializing Aldurazyme in the United States and Europe. The drug was the first approved enzyme replacement therapy for the disorder.

During July 2015, BioMarin became part of the NASDAQ-100 Index. According to the NASDAQ, the NASDAQ-100 Index comprises of 100 largest non-financial stocks. Also, these stocks are listed on the NASDAQ Stock Market based on market capitalization.

Product portfolio expansion

Since inception, BioMarin has grown through acquisitions. Along with organic growth, these acquisitions have helped the company to expand its geographical presence and enhance the product portfolio.

In 2009, BioMarin acquired Huxley Pharmaceuticals Inc. The latter was a privately-held life sciences company. This acquisition provided the company with portfolio expansion as Huxley had rights for the development drug Firdapse for the indication of Lambert Eaton Myasthenic Syndrome (or LEMS). Later in 2010, BioMarin received marketing approval for Firdapse for LEMS in the European Union.

During the first quarter of 2015, BioMarin completed the acquisition of Prosensa Holding NV (RNA). The key objective was to gain access to Prosensa’s experimental drug “drisapersen” indicated for Duchenne muscular dystrophy, or DMD. The drug failed to meet the primary endpoint of the six-minute walk test compared to placebo in phase 3 clinical trial.

Following the failure, GlaxoSmithKline (GSK) walked away from the partnership associated with the drug and returned the product’s rights to Prosensa. Struggling Prosensa came up with the finding that the drug was effective in certain subsets such as younger subjects when administered for a longer period. The drug holds a major advantage as Persona has a lot of data on it.

Sarepta Therapeutics (SRPT) is developing eteplirsen. This product could be a major competitor for drisapersen. The FDA is under pressure from DMD advocates to approve at least one of the two drugs given that both competing drugs are exon-skipping therapies, and there is currently no treatment available for the life-threatening DMD.

Major pharmaceutical and biotechnology companies are following the strategy of acquiring companies with late stage pipeline products. Recently, AbbVie (ABBV) acquired Pharmacyclics (PCYC) to expand its hematological cancer portfolio.

To diversify the risk of investing directly in the equity of BioMarin, investors can look for options such as the iShares NASDAQ Biotechnology ETF (IBB). IBB holds 2.4% of its total holdings in BioMarin stock.