Sarepta Therapeutics Inc

Latest Sarepta Therapeutics Inc News and Updates

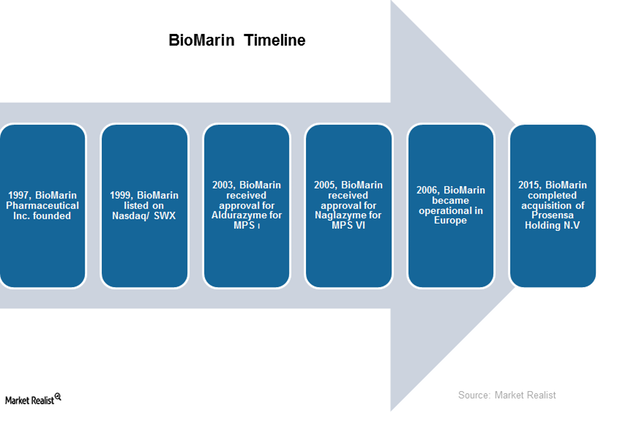

Overview of BioMarin: History and Product Portfolio

Here we present an overview of BioMarin. It’s based in California and was founded in 1997. It focuses on therapies for life-threatening rare genetic diseases.

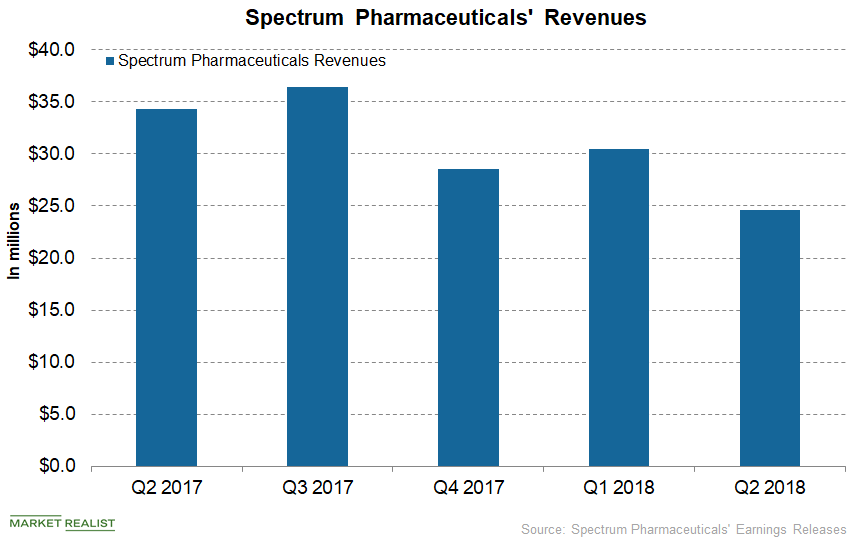

A Look at Spectrum’s Financial Position in September

In the second quarter, Spectrum Pharmaceuticals (SPPI) generated net revenues of $24.2 million compared to $34.3 million in Q2 2017.

Sarepta Therapeutics Stock Rose 96% in 2018

On January 4, Sarepta Therapeutics (SRPT) stock closed at $115.43, which represents ~8.21% growth from its prior close.

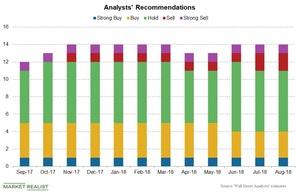

Analysts Have Mixed Opinions about Ionis

Wall Street analysts estimate that Ionis’s (IONS) Q2 2018 revenues will rise ~30.0% to $135.5 million as compared to $104.2 million in Q2 2017.