How Wyndham Uses Technology to Offer Greater Value to Its Clients

Wyndham invests in technology to improve its e-commerce capabilities and marketing abilities and to help it differentiate itself from competitors.

Dec. 22 2015, Updated 2:05 p.m. ET

Technology to bring in new source of revenue

Wyndham Worldwide (WYN) continually invests in technology to improve its e-commerce capabilities and marketing abilities. By investing in technology, the company can also offer services to its clients that help it differentiate itself from competitors while adding new sources of revenue.

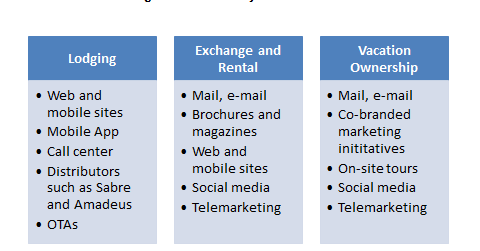

Now let’s look in greater detail at how Wyndham adds value to its clients in its lodging and exchange and rental segments by investing in technology.

Hotel Group segment

Wyndham’s Hotel Group segment offers a huge distribution platform for its franchisees, including its proprietary web and mobile sites and mobile apps. The company also allows its franchisees and receives bookings from third-party distribution channels. Wyndham’s central reservation system is connected to these external channels, which enables its franchisees to utilize inventory more efficiently.

Wyndham also offers its franchisees property management system software and SaaS (software as a service) reservations and revenue management services, which help manage occupancy and ADRs (average daily room rates). These initiatives will likely continue to help increase Wyndham’s revenues moving forward.

Exchange and Rental segment

Wyndham’s Exchange and Rental segment uses its extensive presence in online channels and social media to drive customers to its properties. Enhancements are continuously made to proprietary websites and mobile apps to improve user interface.

The company is also investing in industry-leading technology developed from their own revenue management expertise and advanced yield management techniques to optimize rental and exchange inventory. Automated price changes depending on demand help homeowners achieve more revenue and the company achieves more commission.

Related ETFs

Investors can gain exposure to hotel sector by investing in the iShares Russell 1000 Growth (IWF), which invests ~3% in hotel sector, including 0.09% in Wyndham, 0.14% in Marriott International (MAR), 0.12% in Hilton Worldwide Holdings (HLT), and 0.12% in Starwood Hotels & Resorts Worldwide (HOT). By comparison, the Consumer Discretionary Select Sector SPDR Fund (XLY) invests 14.3% in the hotel sector and has approximately 0.6% of its portfolio in Marriott (MAR), 0.5% in Starwood (HOT), approximately 0.4% in WYN, and about 0.2% in Wynn Resorts (WYNN).

Continue to the next part of this series for a look at Wyndham Worldwide’s vacation ownership.