Will a Rate Hike Pull the Lid off Gold?

Though an increase in rates may initially dim the luster of the metal, after the hike, gold may soar, uninterrupted by looming fears.

Aug. 18 2020, Updated 6:16 a.m. ET

Looming decision

The looming Federal Reserve decision on a rate hike may be keeping a lid on prices of precious metals, especially gold. The world equity rout has lowered expectations for a quick rate rise. Gold prices rose steadily from December 2008 to June 2011. The United States has been fanning inflation concerns, buying additional debt and holding borrowing costs near zero.

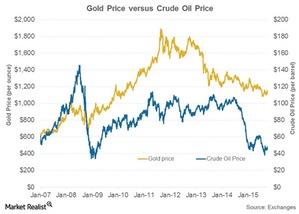

The US inflation languishing below the Fed’s 2% target is fending off gold investors. There’s little hope that gold buying will provide a hedge against rising prices. A slump in crude oil, which has tumbled more than 50% in the last trading year, raised concerns that inflation will stay subdued. Above is a chart of gold and crude oil prices. Falling crude oil prices raise further concerns about inflation, and inflation will, in turn, have an effect on gold prices.

Waning demand

Since 2011, the demand for gold, as well as its appeal as a precious metal, has been waning. Holdings in ETFs backed by the metal have dropped almost 12% over the past year, and on August 11, they shrank to their lowest level since 2009. It seems that once the Fed decides on a rate hike, the lid on the precious metal may be lifted and prices may surge. Though an increase in rates may initially dim the luster of the metal, after the hike, gold may soar, uninterrupted by looming fears.

Gold and silver ETFs such as the SPDR Gold Shares ETF (GLD) and the SPDR S&P Metals and Mining ETF (XME) have fallen 9.8% and 47.9%, respectively, on a YTD (year-to-date) basis. Gold mining companies have also been strongly affected. Companies such as Goldcorp (GG), Royal Gold (RGLD), and Kinross Gold (KGC) have lost ~43%, ~48%, and ~36%, respectively, on a YTD basis. These companies contribute ~15% to the VanEck Vectors Gold Miners ETF (GDX).