How Will Newmont’s Capital Allocation Priorities Look Like?

Newmont Mining outlined its capital allocation priorities. Management mentioned that they aim to fund their projects through cash generated from core operations.

Dec. 9 2015, Updated 2:23 p.m. ET

Capital allocation

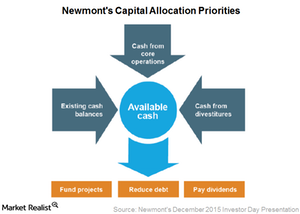

In addition to talking about its operating priorities, Newmont Mining (NEM) also outlined its capital allocation priorities. The company’s management mentioned that they aim to fund their projects through the cash generated from core operations plus the cash available from divestitures. The allocation priorities for capital are funding the projects with the highest returns, reducing debt, and shareholder dividends.

Cash flows versus project spend

The company’s management also mentioned that they expect to generate positive cash from operations in each quarter, but that they can’t time the projects or divestitures on a quarterly basis. So, investors should focus on free cash flow on an annual basis and not on a quarterly one.

Newmont’s free cash flow (or FCF) and cash from divestitures are running ahead of its project spending to date. While the company expects to be FCF-positive at current metal prices in 2016, it will be weighted more towards the back end. This is due to the timing of capital spending for the company, especially as Merian becomes operational in the second half of 2016, when cash inflows start.

Generating free cash flow

For 2015, while the company expects to generate significant FCF in 4Q15, the cash generated from operations might not be enough to cover its project spending. Merian and Long Canyon are both ramping up, and a delay in getting the export permit in Indonesia means a delay in loading and shipping that will, in turn, delay the sales and cash flows.

In a weak gold price environment (GLD) (IAU), the ability of mining companies to generate FCF comes under pressure. Due to their focus on cost-cutting and optimizing production, other miners such as Barrick Gold (ABX), AngloGold Ashanti (AU), Agnico Eagle Mines (AEM), and Goldcorp (GG) have also started reporting positive FCFs.