An Overview of Becton, Dickinson and Company’s Business Model

On October 1, 2015, BD underwent organizational restructuring to better align its business model to the strategic vision and goals of the company.

Dec. 11 2015, Updated 6:35 p.m. ET

Becton, Dickinson and Company’s business model

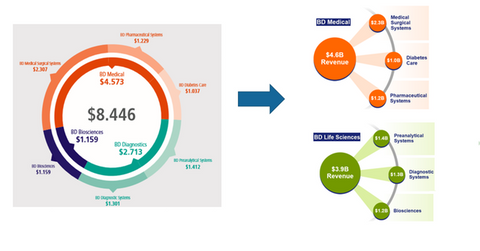

Becton, Dickinson and Company (BDX), or BD, operated under three business segments until 2014. It then underwent organizational restructuring, effective October 1, 2015, to better align its business model to the strategic vision and goals of the company. Consequently, the company operates under two business segments: BD Medical and BD Life Sciences.

BD Medical

This segment focuses on clinical healthcare requirements and aims to expand the scale of the solutions and therapies provided to healthcare delivery participants such as hospitals, clinics, and pharmaceutical companies. It consists of several subsegments, as depicted in the diagram above, and provides innovative solutions to reduce the spread of infections, treat diabetes, and deliver drugs effectively. Some of BD Medical’s principal products include syringes and pen needles for diabetes treatment and prefillable drug delivery systems. On a comparable currency basis, the segment’s revenues increased by 5.5% in 2015 over fiscal 2014.

BD Life Sciences

BD Life Sciences targets customers in research and laboratory settings. The segment provides products and solutions for the study of cells, the management and diagnosis of various diseases, and the safe collection and transport of diagnostic samples and specimens. Some of BD Life Sciences’ principal products are fluorescence-activated cell sorters and analyzers, cell imaging systems, and integrated systems for specimen collection. On a comparable currency basis, the segment’s revenues increased by 5% in 2015 over fiscal 2014.

BD’s major competitors are Johnson & Johnson (JNJ), Baxter (BAX), and Medtronic (MDT). Investors seeking diversified exposure to BD can invest in the First Trust Health Care AlphaDEX ETF (FXH). The company accounts for around 1.5% of FXH’s total holdings.