Dissecting Abbott Laboratories: A Key Business Model Analysis

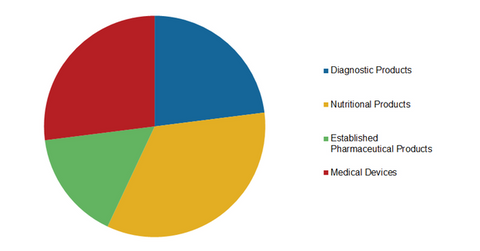

Since 2013, Abbott Laboratories has generated revenues from a diversified healthcare business spanning across geographies and four primary segments.

Jan. 29 2016, Updated 7:11 p.m. ET

Abbott Laboratories’ business overview

Since 2013, Abbott Laboratories (ABT) has generated revenues from a diversified healthcare business spanning across geographies and following primary segments:

- Nutritional Products

- Diagnostic Products

- Established Pharmaceuticals

- Medical Devices

Prior to the spin-off of AbbVie (ABBV), which became effective on January 1, 2013, the company reported its operations under five segments, which included Proprietary Pharmaceutical Products.

Abbott’s Medical Devices segment

Medical devices segment of Abbott Laboratories consists of the following sub-segments:

- Vascular Devices

- Vision Care

- Diabetes Care

The Medical Devices segment accounts for around 27% of the company’s total revenues. Some of the breakthrough products in Abbott’s Vascular Devices sub-segment include Mitraclip, a minimally invasive technology that performs mitral valve repair in the treatment of heart disorders, and Supera, a peripheral stent system for treating certain artery diseases of the leg. Medtronic (MDT) is one of the major competitors in this space.

Established Pharmaceuticals segment

Abbott’s Established Pharmaceuticals segment operates in 88 countries in emerging markets but ceased to operate in developed countries after the sale of its Developed Markets division of pharmaceutical products to Mylan in 2015. It has a product portfolio of more than 1,500 products, with mostly consumer-oriented operations, as substantiated by a consumer mix consisting of 75% direct-paying consumers and 25% third-party payers.

Abbott’s Established Pharmaceuticals segment accounted for 16% of the company’s total revenues in 2014.

Nutritional Products segment

Abbott’s Nutritional Products segment consists of a broad portfolio of products such as Similac for infants, Pediasure nutrition supplements, Nepro for dialysis patients, and Glucerna for diabetes patients. Abbott’s nutritional product segment consists of nutritional products for adults as well as infants.

Abbott is the global leader in adult nutrition, which accounts for 44% of the segment’s revenue. Some major competitors in this space include Johnson & Johnson (JNJ) and Bristol-Myers Squibb Company.

Diagnostic Products segment

Abbott’s Diagnostic Products segment accounts for 23% of the company’s total revenues. The company is a leader in blood screening and immunoassay testing, which involves tests used to detect specific molecules for the presence of specific antibodies in body fluids. Abbott’s sales from its Diagnostic Products segment increased by 6.4% in 2014. Major competitors in this space include Becton Dickinson and Company and Medtronic.

One of the major ETFs with exposure to Abbott Laboratories (ABT) is the Health Care Select Sector SPDR Fund (XLV), which has 2.1% of its total holdings in ABT.

Now let’s look more specifically at Abbott Laboratories’ Nutritional Products segment.