Depressed Iron Ore Prices Will Strain BHP Billiton’s Cash Flows

Iron ore forms the biggest chunk of BHP Billiton’s revenues and earnings. For its latest quarter, the company delivered 7% year-over-year growth.

Dec. 17 2015, Updated 8:06 a.m. ET

Iron ore guidance under review

Iron ore forms the biggest chunk of BHP Billiton’s (BHP) (BBL) revenues and earnings. For its latest quarter (ending September 2015), the company delivered 7% year-over-year growth.

While earlier, the company’s guidance for iron ore production was 247 million tons for fiscal 2016, following the Samarco incident, it’s kept its guidance under review. Samarco has the capacity to produce 30.5 million tons of iron ore per year. According to BHP, in fiscal 2015, its share of Samarco’s production was 14.5 million tons, and Samarco contributed to 3% of BHP’s underlying EBIT (earnings before interest and tax).

Most experts believe that Samarco will be out for at least one to two years given its legal and environmental issues. This will impact BHP’s volumes as well as its earnings, though not significantly.

Depressed iron ore prices

The more important variable impacting BHP’s profitability in iron ore is the benchmark price. BHP and other major miners have a stated strategy of flooding the market with iron ore to drive out higher-cost suppliers, which has worked somewhat but has taken a toll on iron ore prices. Benchmark cost and freight (or CFR) China iron ore prices touched a low of $38 per ton on December 11, 2015.

Can BHP still make money?

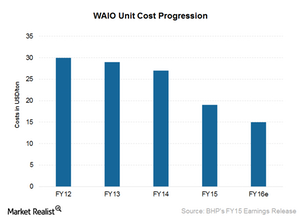

BHP’s iron ore cash cost for the half-year ended June 30, 2015, was $17 per ton. Rio Tinto’s (RIO) was $16.2 per ton, and Vale’s (VALE) was $12.7 per ton in 3Q15. BHP expects unit costs to drop to $15 per ton.

According to UBS, the breakeven cost for BHP is close to $29 per ton (including freight). While BHP can still make some money at the current spot price of $39 per ton, the pressure on its margins in increasing. Vale forms 2.2% of the iShares MSCI Brazil Capped ETF (EWZ).

The question for BHP is not one of survival but of shareholder returns. The recent drop in iron ore prices along with the drop in other commodities (DBC) has spooked investors, leading to a sell-off.

In the next part of this series, we’ll see if BHP’s focus on productivity in the coal division could see it through the rough phase in coal prices.