How Are Dry Bulk Companies Changing Their Chartering Strategies?

Navios Maritime Partners (NMM) and Diana Shipping (DSX) have a chartering strategy to charter the bulk of their vessels for the long term, thus holding high fixed-rate exposure.

Jan. 4 2016, Updated 8:06 a.m. ET

Spot versus time charter contracts

Dry bulk shipping companies usually work under two types of contracts: spot charter contracts and time charter contracts. Spot exposure measures the extent to which vessels are exposed to the spot market contract. Under time charter contracts, vessels are hired for a specific period, which can last up to seven or eight years at a predetermined daily rate, or they’re pegged to the spot rates or an index.

It’s worth noting that companies with high exposure to long-term contracts underperform in times of improving rates since they’re not able to take advantage of higher spot rates, and vice versa. Currently, the time charter rates have taken a dive along with the spot rates. The one-year time charter rates for Capesizes are currently sitting at $6,500 per day compared to $13,000 per day one year ago. In a weak freight rate environment, dry bulk companies are changing their strategies away from locking these low rates for an extended period of time.

In this article, we’ll analyze which company uses which strategy and how it impacts performance.

Operating on spot

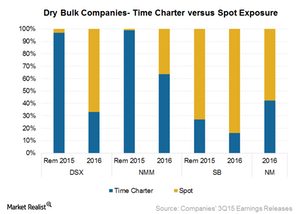

Safe Bulkers (SB) has more spot exposure with just 27% of days covered by time-charter contracts for the remaining 2015 and 16% for 2016. Its management mentioned during the 3Q15 earnings call that since long-term charters are not available at this low point in the market, the company will keep on operating between the spot market and the short period market. So it isn’t always in a company’s control to change its chartering strategy. It also depends on market conditions and the opportunities available.

Scorpio Bulkers (SALT) also usually chart out vessels in the spot market. However, management mentioned that although the company is not averse to fixing vessels for long-term charter. it doesn’t believe the time is right to go for long-term charters.

High fixed-rate exposure

In contrast, Navios Maritime Partners (NMM) and Diana Shipping (DSX) have a chartering strategy to charter the bulk of their vessels for the long term, thus holding high fixed-rate exposure. The average charter duration for NMM’s entire fleet is three years, which also includes containership charters. Most of its dry bulk charters are expiring in the next two years.

A total of 63.7% of days is covered by fixed revenues for 2016. The figure for DSX is 33% for 2016. Diana has recently started chartering vessels for a shorter duration, as it wants to maintain flexibility in terms of market timing. Its management tries to position the vessels to open at different times in the cycle.

Navios Maritime Holdings (NM) has 42.4% of fixed revenue days for 2016, including index-linked days.

NMM and DSX have an advantage, as they locked in higher rates when the market was strong. But most of their contracts are rolling in 2016, which could lead to a downside in their revenues going forward.

Investors interested in broad exposure to industrials can invest in the SPDR Dow Jones Industrial Average ETF (DIA).