What is CF Industries’ Capital Expenditures Ratio Telling Us?

CF Industries’ cash flow to capital expenditure ratio has been falling. CF Industries’ cash flow to capital expenditure ratio stands at 0.75 as of 3Q15.

Dec. 1 2015, Published 2:47 a.m. ET

Capital expenditures

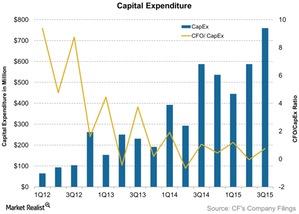

Previously, we looked at how CF Industries (CF) has managed its cash. We noted that its free cash flows have been declining over the years. Because free cash flow is calculated by subtracting capital expenditures from operating cash flows, we must look at the capital expenditure trend as well.

Cash flow–capital expenditure ratio

As shown in the chart above, CF Industries’ cash flow to capital expenditure ratio has been falling. Usually, a falling cash flow–capital expenditure ratio is not considered positive because it says that the company does not have the financial ability to invest in the assets to grow its business.

However, bear in mind that players in the fertilizer business invested heavily with the anticipation of growth in commodity prices between 2008–2013, resulting in excess capacity. CF Industries’ cash flow to capital expenditure ratio stands at 0.75 as of 3Q15.

Comparing with peers

Let’s see how other similar companies in the industry stand. Potash Corporation (POT) has a cash flow–capex ratio of 1.2, Mosaic’s (MOS) ratio is 1.1, and Yara International has a ratio of 1.9. So, CF’s ratio of 0.75 makes it appear weaker compared to the above companies in terms of having the financial strength to invest in its assets.

You may also access these companies through the VanEck Vectors Agribusiness ETF (MOO), which invests 18.4% of its holdings in CF Industries, Mosaic, Agrium (AGU), and Potash Corporation.

To fund capital investments, companies often take on leverage. Given the weakness in CF Industries’ internal sources of finance, we will look at CF Industries’ leverage trends in the next part.