What Made Kellogg Update Its Fiscal 2016 Guidance?

In its fiscal 2Q16 earnings release, Kellogg stated that it expects its fiscal 2016 cash flow from operating activities to be ~$1.7 billion.

Aug. 12 2016, Updated 9:04 a.m. ET

Kellogg updates fiscal 2016 guidance

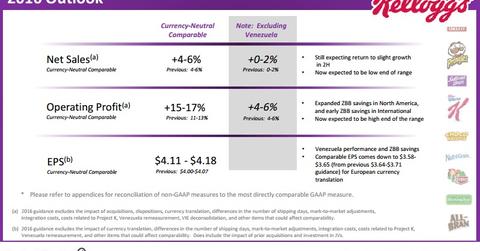

Kellogg (K) updated its guidance for currency-neutral comparable net sales, operating profit, and EPS (earnings per share). This came on the back of a 1H16 profit in Venezuela’s inflationary environment, along with an updated forecast for operating profit margin for the rest of the business. We discussed the updated EPS guidance earlier in this series. The company is consistent with its previous net sales growth guidance of 4%–6%. However, excluding the impact from Venezuela, the company expects sales should be in the lower end of the 0%–2% range.

Increased operating profit guidance

Venezuela’s profit performance in 1H16 made Kellogg increase its operating profit guidance. It now expects operating profit growth excluding Venezuela will be at the higher end of the 4%–6% growth range. The company expects to benefit from higher savings from ZBB (Zero-Based Budgeting) in North America and similar programs in its international regions. Savings through ZBB are projected to be roughly $150 million–$180 million for the year. The currency-neutral comparable operating profit is now expected to increase by 15%–17%, which is greater than the previous estimate of 11%–13%.

Other related guidance

In its fiscal 2Q16 earnings release, Kellogg also stated that it expects its fiscal 2016 cash flow from operating activities to be ~$1.7 billion. The company also reaffirmed that it expects its fiscal 2016 cash flow to be ~$1.1 billion. This includes capex (capital expenditure), which is expected to be 4%–5% of sales, which will be around $525 million–$625 million. Capital expenditure includes the effect of the cash required by Project K. It also includes an increase in capital spending of ~1% of sales related to the growth of the Pringles business.

Kellogg’s peers in the industry include The Hershey Company (HSY), Cal-Maine Foods (CALM), and Mead Johnson Nutrition Company (MJN). Hershey and Mead Johnson Nutrition Company have seen YTD (year-to-date) returns of 23.6% and 11.2%, respectively, while Kellogg and Cal-Maine Foods have seen YTD returns of 14.3% and -6.2%, respectively, as of August 5. The PowerShares S&P 500 Quality Portfolio (SPHQ) invests ~1.1% of its holdings in Kellogg.

In the next part of this series, we’ll look at Kellogg’s recently announced dividend.