Could the Rite Aid–Walgreens Merger Get Competitive?

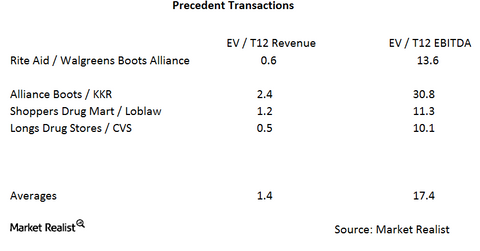

In the Rite Aid–Walgreens merger, Walgreens is paying about 0.6x trailing-12-month revenues and 13.6x trailing-12-month EBITDA.

Dec. 4 2020, Updated 10:53 a.m. ET

Competitive deals can make your quarter

Competitive deals can make your quarter if you’re a merger arbitrage professional. If you get two companies bidding against each other, a 1% gross spread can easily become a 10% gross spread by the time everything is said and done. We saw that happen in the Salix Pharmaceuticals deal.

Could a competitor break up the Rite Aid–Walgreens merger?

We don’t know if Rite Aid (RAD) ran a process to sell the company. Companies typically refer to the sale process as “examining strategic alternatives.” Usually you don’t get any definitive answers until the preliminary proxy statement comes out. As part of the preliminary proxy statement, there’s always a section regarding the background to the merger. That’s where you find out if the seller ran a process. If the seller did run a process, then it is unlikely another buyer will emerge. Note that since this deal appears to have some antitrust issues, a potential buyer may prefer to wait and see how the regulatory process plays out before making a move.

Deal comparisons

Arbitrageurs often compare the price the acquirer is paying to the prices of other deals in the same industry. This is always more art than science, since no two companies are alike and interest rate environments change. The best comparisons for this transaction include:

- Alliance Boots–KKR & Co.

- Shoppers Drug Mart Corporation–Loblaw Companies

- Long’s Drugs–CVS Pharmacy

These transactions are about the closest comparisons we have to the merger between Rite Aid (RAD) and Walgreens Boots Alliance (WBA).

In this transaction, Walgreens is paying about 0.6x trailing-12-month revenues and 13.6x trailing-12-month EBITDA (earnings before interest, tax, depreciation, and amortization). These multiples are below the averages in the other transactions, which work out to be about 1.4x trailing-12-month revenues and 17.4x trailing-12-month EBITDA.

Realistically, the only other buyer that would make sense would be CVS Pharmacy, but it would face the same antitrust hurdles that Walgreens faces. In addition, CVS Pharmacy doesn’t need to buy access to the pharmacy benefit business. In this deal, consider the chance of another buyer surfacing to be relatively low.

Other merger arbitrage resources

Other important merger spreads include the Cigna Corporation (CI)–Anthem (ANTM) deal, which is slated to close in 2H15. For a primer on risk arbitrage investing, read “Merger Arbitrage Must-Knows: A Key Guide for Investors.”

Investors who are interested in trading in the healthcare sector can look at the S&P SPDR Healthcare ETF (XLV).