Must Know: What Value Can Elliott Management Add to Alcoa?

Elliott Management noted that it plans to engage in a “constructive dialogue” with Alcoa’s (AA) board regarding Alcoa’s split transaction and “additional available opportunities to maximize shareholder value.”

Nov. 20 2020, Updated 3:34 p.m. ET

Elliott Management

Elliott Management noted that it plans to engage in a “constructive dialogue” with Alcoa’s (AA) board regarding Alcoa’s split transaction and “additional available opportunities to maximize shareholder value.” There are several examples where activist investors had to push hard to persuade management to take steps that they believed would create shareholder value.

However, Alcoa’s management has been fairly active itself in trying to maximize shareholder value. Alcoa has been proactive in cutting its high-cost smelting capacity while growing its value-added portfolio. Together, Alcoa (AA) and Ball Corporation (BLL) form ~4.1% of the Materials Select Sector SPDR ETF (XLB).

Can Elliott Management add value?

According to a CNBC report, Elliott Management could push Alcoa into selling its power generation unit. Alcoa has a captive power generation capacity of ~1,550 MW (megawatts). Out of this, the company currently uses ~30% for its captive needs while the remainder is sold into the power grid. Other aluminum companies such as Rio Tinto (RIO) and Norsk Hydro (NHYDY) also have captive power generation units.

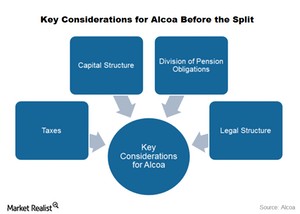

One of the biggest concerns that markets have regarding Alcoa’s split relates to how its debt and underfunded pension plan would be split between the two companies. Alcoa had a total debt of $9.27 billion as of September 30, 2015. Alcoa also had an underfunded pension funding of ~$3.3 billion as of December 31, 2014.

Would selling power plants help?

Alcoa (AA) can generate upfront cash by selling its power generation units. This could help the company lower its leverage ratios. Lower financial leverage could help Alcoa meet its targeted rating profiles for the new companies. Alcoa is aiming for an investment-grade (BND) credit rating for its value-added company while maintaining a strong noninvestment-grade rating for the upstream company. The credit ratings would depend to a large extent on how much debt is placed on the balance sheets of these companies.

By selling the power generation units, Alcoa would lose a revenue stream. However, Alcoa’s management primary current concern would be to manage the leverage ratios after the proposed split. Looking at the current low price scenario, the upstream company would especially be prone to financial strain.

Please continue to visit Market Realist’s Aluminum page for ongoing developments in this industry.