Moving Average Analysis of Chinese Energy Companies

Chinese energy companies CNOOC, China Petroleum & Chemical, and PetroChina Company have fallen below their 100-day and 20-day moving averages.

Jan. 29 2016, Updated 12:06 p.m. ET

Moving averages of China-based energy companies

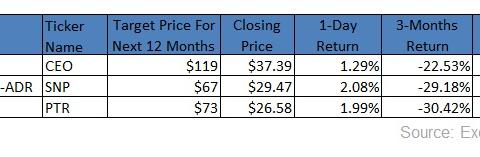

Chinese energy companies CNOOC (CEO), China Petroleum & Chemical Corporation (SNP), and PetroChina Company (PTR) have fallen below their 100-day and 20-day moving averages by an average of 2.1% and 0.6%, respectively. CEO, SNP, and PTR are trading approximately 2.7%, 2%, and 1.9%, respectively, below their 100-day moving averages.

Notably, SNP’s 52-week high is about $96.41. The stock is currently trading 43% below that 52-week high. The stock’s 52-week low is around $50. In past, it has tested the psychological support of $50 in February 2009 after the sub-prime crisis of 2007–2008.

Understanding XLE and what moving averages indicate

The energy sector benchmark, the Energy Select Sector SPDR Fund (XLE), is trading 13.3% below its 100-day moving average and 2.3% below its 20-day moving average. The United States Oil Fund (USO) is trading 7.1% below its 20-day moving average.

Moving averages are lagging indicators used to confirm an existing trend. When an underlying asset’s price is above its long- and short-term averages, this indicates a rising trend and vice versa. Moving averages provide important support and resistance levels for an underlying asset’s movement.

Analyst estimates for China-based oil

Wall Street estimates suggest that China-based oil and gas companies may rise by an average of 173% over the next 12 months. These estimates indicate rises of 218%, 127%, and 173%, respectively, from current prices for CNOOC, China Petroleum & Chemical, and PetroChina. The graph above shows the moving averages and analyst estimates for these Chinese energy companies.

In the next part of this series, we’ll keep analyzing moving averages and analyst estimates, but we’ll shift our focus to upstream energy companies.