Iron Ore Companies’ Production Continues Unabated Growth

The weak demand from China is hurting iron ore prices. The supply side, on the other hand, remains quite strong.

Nov. 20 2015, Updated 4:16 p.m. ET

Supply outlook remains strong

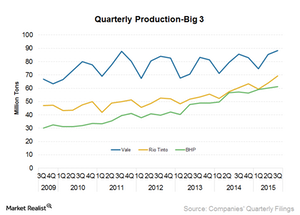

The weak demand from China is hurting iron ore prices. The supply side, on the other hand, remains quite strong. In their latest quarterly reports, iron ore majors reported record quarterly iron ore production numbers.

BHP Billiton’s (BHP) (BBL) iron ore production for 1Q16 was 61 million tons, a growth of 7% year-over-year (or YoY). BHP management has kept its expectations unchanged. It plans its total production to increase by 6% in fiscal 2016 to 247 million tons, driven by improved efficiency at Mining Area C, Newman, and rail and port operations.

Rio Tinto (RIO) also set a quarterly production report, with 3Q15 attributable production coming in at 69.3 million tons, which is 15% higher YoY. RIO maintained its guidance for 2015 shipments at 340 million tons (on a 100% basis) from its operations in Australia and Canada.

Vale’s S11D ramping up on schedule

Vale SA (VALE) also recorded its highest ever iron ore production of 88.2 million tons for 3Q15, primarily due to increased production at its Carajas mine. Its 90 million tons per annum S11D project is also ramping up quickly and is slated to come online in the second half of 2016.

The strong iron ore supply outlook, coupled with weaker demand, has put unprecedented pressure on iron ore prices since mid-2014. This is the main reason why iron ore prices have plunged more than 30% year-to-date.

The iShares MSCI Brazil Capped ETF (EWZ) invests in large-cap and mid-cap companies in Brazil. Vale forms 2.8% of EWZ’s ETF holdings. CLF forms 3.7% of the SPDR S&P Metals and Mining ETF (XME) holdings.