What Is the Dodd-Frank Act?

The Dodd-Frank Act is a financial reform legislation passed in an attempt to prevent events similar to the 2009 financial crisis from occurring again.

Nov. 16 2015, Updated 7:47 p.m. ET

Nuances of the Dodd-Frank Act

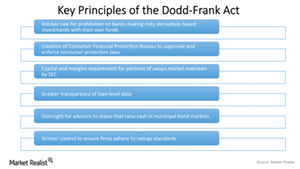

The Dodd-Frank Wall Street Reform and Consumer Protection Act is a financial reform legislation passed by the Obama administration in 2010. It was passed in an attempt to prevent events similar to the 2009 financial crisis from occurring again.

The Act primarily affects financial institutions, such as banks (KBE), and their customers. It established new government agencies that monitor the performance of financial institutions that are often deemed “too big to fail.” Some of these “too big to fail” institutions are as follows:

The agencies established under this law had the power to liquidate or restructure companies that they found to be financially weak and that could pose a threat to the financial system due to their sheer size.

Another part of this Act, the Volcker Rule, implements restrictions on the way in which banks can invest and trade in the derivatives space. The Act also requires banks to hold more cash in hand. It has placed stricter rules on lending, which makes it harder for banks to be profitable.

Analysts’ view of the Act

Analysts who favor this Act believe that it will protect the investing community as well as consumers from experiencing a situation similar to that of the 2009 crisis. Critics of the Dodd-Frank Act believe that it will hamper economic growth and hurt the competitiveness of US banks relative to their foreign peers.

Some analysts are of the view that the Dodd-Frank Act does not address the major source of the 2009-crisis, that is, the housing finance companies. Fannie Mae and Freddie Mac, the culprits of the crisis, are unaffected by the Act.

Most banks state that implementation of this act has resulted in higher compliance costs for them. This has impacted their profitability negatively and has harmed their competitiveness compared to their foreign counterparts. Also, these costs will ultimately be passed on to consumers, which would make banking activities more expensive for them.

But how do these regulations impact the different sub-groups within the financial services sector?

Continue to the next part of this series to find out.