How Price Impacts Iron Ore Inventory

China’s (MCHI) iron ore port inventory is a key indicator that reflects the commodity’s supply-and-demand balance.

Nov. 20 2020, Updated 1:29 p.m. ET

China’s iron ore port inventory

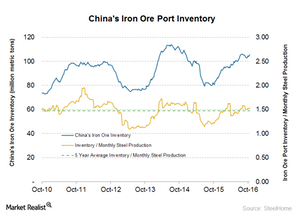

China’s (MCHI) iron ore port inventory is a key indicator that reflects the commodity’s supply-and-demand balance. It also indicates the safety net and imbalance between iron ore supply and steel mill demand. High inventory is a sign of weak demand for raw materials, and vice versa.

Inventories are rising slowly

While iron ore inventories started falling after reaching a high in July, the latest data point reveals that they’ve again started inching up. For the week ending October 21, 2016, inventories totaled 105.8 million tons, which translates to an inventory-to-steel production ratio of ~1.5x. This ratio is often preferred by analysts over raw inventory figures for tracking progress in the sector. The ratio measures how much inventory is available to keep steel production activity going.

Increasing inventories at ports amid steel demand that doesn’t seem sustainable could hurt iron ore prices. This trend is also negative for iron ore players involved in the seaborne iron ore trade, including BHP Billiton (BHP) (BBL), Rio Tinto (RIO), Vale SA (VALE), and Cliffs Natural Resources (CLF).

Notably, the SPDR S&P Global Natural Resources ETF (GNR) tracks the natural resources index, and BHP makes up 5.0% of GNR’s portfolio holdings.

In the next part of this series, we’ll look at the outlook for China’s steel production and demand. Production and demand are vital in order to determine the outlook for seaborne iron ore prices.