JP Energy Partners: Top Midstream MLP Loser on September 2

JP Energy Partners (JPEP) was the top loser among midstream MLPs at the end of trading on September 2, falling 8.08%. JPEP stock has been on a roller coaster ride for the past few days.

Sept. 3 2015, Published 12:40 p.m. ET

Top losers

In the previous article, we saw the top five midstream MLP gainers on September 2. In this article, we’ll take a look at the top five midstream MLP losers on the same day.

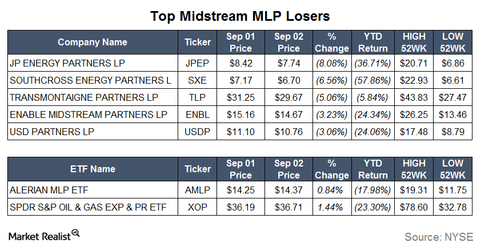

JP Energy Partners

JP Energy Partners (JPEP) was the top loser among midstream MLPs at the end of trading on Wednesday, September 2. JPEP fell 8.08%. JPEP stock, which recently breached its 52-week low, has been on a roller coaster ride for the past few days. With yesterday’s loss, JPEP’s year-to-date returns moved down to -36.71%. The company mainly provides crude oil, refined products, and NGL (natural gas liquids) gathering, transportation, and storage services.

Southcross Energy Partners

Next on our list of top five midstream MLP losers on September 2 is Southcross Energy Partners (SXE). It fell 6.56% yesterday. SXE has lost 57.8% of its market value since the beginning of this year. SXE’s poor year-to-date market performance can be attributed to its significant exposure to natural gas and NGL prices. The partnership mainly provides natural gas gathering, processing, treating, compression, and transportation services. SXE is also engaged in natural gas and NGL acquisition and marketing.

Other losers

TransMontaigne Partners (TLP), Enable Midstream Partners (ENBL), and USD Partners (USDP) were among the top five midstream MLP losers on Wednesday, September 2. TLP, ENBL, and USDP fell 5.06%, 3.23%, and 3.06% in the last trading session, respectively. They’ve returned -5.84%, -24.34%, and -24.06% year-to-date.

The Alerian MLP ETF (AMLP) and the Global X MLP & Energy Infrastructure ETF (MLPX) have returned -17.98% and -17.74% year-to-date. For context, the upstream energy company heavy, the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), has returned -23.30% year-to-date.