Nordstrom Completes Sale of Credit Card Portfolio to TD Bank

On October 1, Nordstrom (JWN) announced the completion of the sale of its credit card portfolio to Toronto-Dominion Bank (TD), also known as TD Bank.

Nov. 20 2020, Updated 1:09 p.m. ET

Sale of credit card portfolio

On October 1, Nordstrom (JWN) announced the completion of the sale of its credit card portfolio to Toronto-Dominion Bank (TD), also known as TD Bank. Nordstrom’s existing US Visa and private label consumer credit card portfolio is worth $2.2 billion. The company had initially announced the transaction in May 2015. The agreement between Nordstrom and TD Bank has an initial term of seven years and can be renewed for a further two years subject to certain conditions.

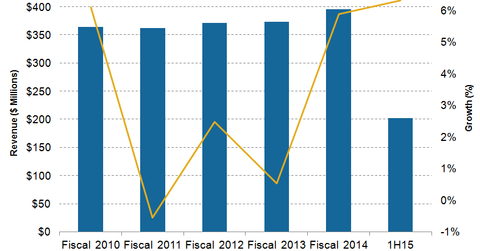

In the first half of fiscal 2015, ended August 1, 2015, Nordstrom’s credit card business generated revenue of $202 million—up 6.3% on a year-over-year basis. The credit card business generated an EBIT (earnings before interest and income taxes) of $161 million in 1H15. Nordstrom constitutes 0.2% of the portfolio holdings of the iShares Russell Mid-Cap ETF (IWR) and 0.9% of the SPDR S&P Retail ETF (XRT).

Rationale behind the sale

With the sale of its credit card portfolio, Nordstrom can improve its capital efficiency by employing the freed-up capital resources for more profitable growth opportunities. Nordstrom’s credit card portfolio sale will also help the company focus completely on its core retail business. For TD Bank, the transaction further expands its North American credit card business.

Terms of the agreement

According to the agreement, Nordstrom will perform all servicing functions associated with the credit card portfolio and will also have the primary responsibility for the marketing of Nordstrom-branded Visa and private label cards. This will help the upscale department store to remain in touch with its customers. Nordstrom will continue to fund and manage its rewards loyalty program, Nordstrom debit cards, and Nordstrom employee accounts.

The net revenue from the credit card portfolio will be shared by Nordstrom and TD Bank. Nordstrom will have the option to repurchase the entire credit card portfolio upon termination of the agreement.

Nordstrom and TD Bank have also entered into a separate long-term agreement, pursuant to which TD Bank will become the exclusive issuer of Nordstrom-branded Visa and private label consumer credit cards in the United States.

In the past, retailers such as Macy’s (M), Kohl’s (KSS), and Target (TGT) also sold their credit card portfolios. Target sold its credit card portfolio to TD Bank in March 2013. Macy’s sold its credit card portfolio to Citigroup (C) in 2005, and Kohl’s completed the sale of its credit card business to JPMorgan Chase (JPM) in 2006.

Nordstrom’s sale of its credit card business to TD Bank drew a positive reaction from its investors. The next article in this series discusses this reaction.