Why Did Leveraged Loans’ Issuance Fall?

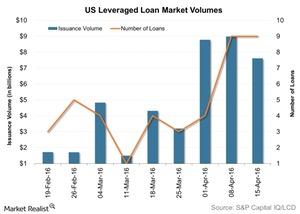

The US leveraged loans market saw an allocation of $7.6 billion worth of dollar-denominated senior loans in the week to April 15.

April 25 2016, Updated 11:07 a.m. ET

Primary market activity in leveraged loans

According to data from S&P Capital IQ/LCD, the US leveraged loans market saw an allocation of $7.6 billion worth of dollar-denominated senior loans in the week to April 15. In the previous week, the issuance stood at $9.0 billion—the highest year-to-date. The deal flow remained unchanged. Nine transactions were priced last week.

Senior loans are tracked by mutual funds and ETFs such as the Oppenheimer Senior Floating Rate Fund – Class A (OOSAX), the Fidelity Advisor Floating Rate High Income Fund – Class A (FFRAX), the Invesco PowerShares Senior Loan Portfolio (BKLN), and the Highland/iBoxx Senior Loan ETF (SNLN).

Noteworthy transactions

Samsonite International SA is a travel luggage company. It issued Ba2/BBB- rated dollar-denominated leveraged loans worth $2.43 billion in three tranches on April 13:

- a $500 million five-year RCF (Revolving Credit Facility) issued at LIBOR + 275 basis points

- a $1.25 billion five-year Term Loan A issued at LIBOR + 275 basis points

- a $675 million seven-year Term Loan B issued at LIBOR + 325 basis points with a LIBOR floor of 0.75% an OID (original issue discount) of 99.5

The proceeds from the offerings will be used to acquire Tumi Holdings (TUMI).

Quorum Health operates and manages general acute care hospitals and outpatient services in the US. It issued B1/B rated leveraged loans worth $980 million in two tranches on April 12:

- a $100 million five-year RCF

- a $880 million six-year Term Loan B issued at LIBOR + 575 basis points with a LIBOR floor of 1.0% an OID of 98

The company intends to use the proceeds of the offering to back its spin-off from Community Health Systems (CYH).

Atlantic Power (AT) owns and operates a diverse fleet of power generation assets in the US and Canada. It issued Ba3/BB- rated leveraged loans worth $900 million in two tranches on April 13:

- a $200 million five-year RCF

- a $700 million seven-year Term Loan B issued at LIBOR + 500 basis points with a LIBOR floor of 1.0% an OID of 97

The company expects to use the net proceeds for the refinancing purpose.

Pinnacle Entertainment (PNK) owns and operates gaming entertainment businesses. It issued Ba2/BB+ rated leveraged loans worth $885 million in three tranches on April 13:

- a $400 million five-year RCF issued at LIBOR + 200 basis points

- a $185 million five-year Term Loan A issued at LIBOR + 200 basis points

- a $300 million seven-year covenant-lite Term Loan B issued at LIBOR + 300 basis points with a LIBOR floor of 0.75% an OID of 99.8

The company expects to use the net proceeds for the acquisition of Gaming & Leisure Properties (GLPI).

In the next part, we’ll look at leveraged loan funds flows.