Oppenheimer Senior Floating Rate Fund

Latest Oppenheimer Senior Floating Rate Fund News and Updates

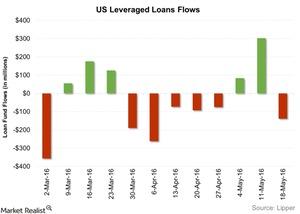

Why Leveraged Loan Funds Saw Outflows Last Week

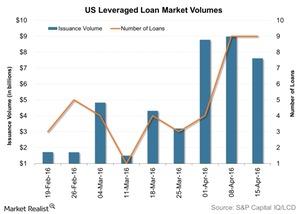

According to S&P Capital IQ Leveraged Commentary & Data, three collateralized loan obligation deals worth $1.4 billion were priced last week.

Why Did Leveraged Loans’ Issuance Fall?

The US leveraged loans market saw an allocation of $7.6 billion worth of dollar-denominated senior loans in the week to April 15.