Gaming and Leisure Properties, Inc.

Latest Gaming and Leisure Properties, Inc. News and Updates

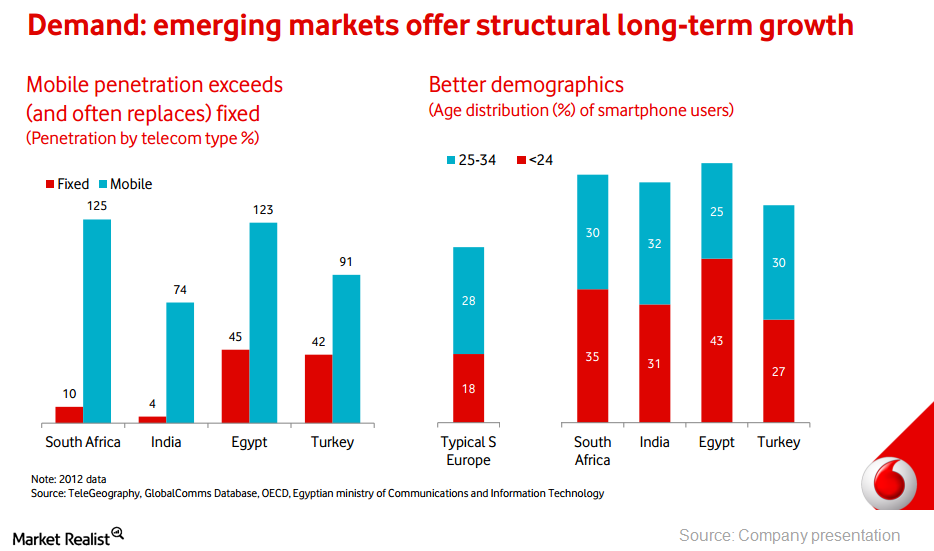

Why AQR Capital Management chose to open a position in Vodafone

AQR Capital started a new position in Vodafone Group plc that accounts for 0.44% of the fund’s 4Q portfolio.Financials Omega Advisors buys stake in IntercontinentalExchange

Omega Advisors opened a new 1.36% position in Intercontinentalexchange (ICE), a leading operator of global markets and clearing houses, in the fourth quarter.Consumer Must-know: Penn National Gaming’s performance metrics

Performance metric Penn National Gaming, Inc. (PENN) defines adjusted EBITDA as earnings before interest, taxes, stock compensation, debt-extinguishment charges, impairment charges, insurance recoveries and deductible charges, depreciation and amortization, gain or loss on disposal of assets, and other income or expenses. Adjusted EBITDAR is adjusted EBITDA excluding rent expenses such as those associated with PENN’s […]

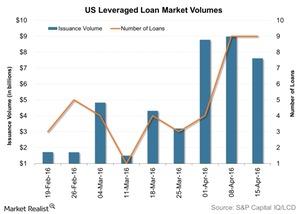

Why Did Leveraged Loans’ Issuance Fall?

The US leveraged loans market saw an allocation of $7.6 billion worth of dollar-denominated senior loans in the week to April 15.

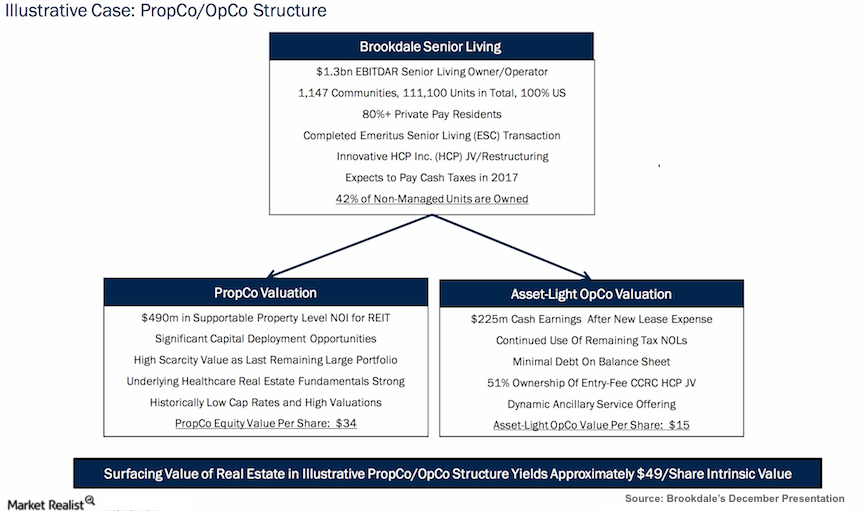

Why Sandell wants a spin-off of Brookdale’s real estate assets

Sandell has proposed a spin-off of Brookdale’s real estate assets into an REIT. It’s a tax-free spin-off that avoids double taxation on income distribution.