Why Is JCPenney’s Center Core a Critical Growth Driver?

JCPenney (JCP) has been focusing on revitalizing the center core of its stores. JCPenney uses the term “center core” to represent the categories that customers expect to find in the center of its store.

Oct. 1 2015, Published 1:20 p.m. ET

Focus on center core

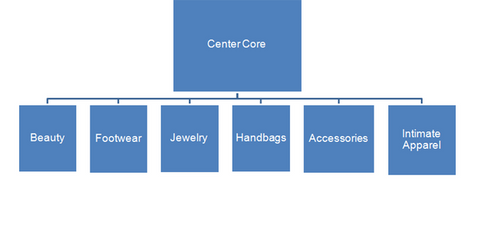

JCPenney (JCP) has been focusing on revitalizing the center core of its stores. JCPenney uses the term “center core” to represent the categories that customers expect to find in the center of its store. JCpenney’s center core products include Sephora (LVMUY) store-within-a-store, footwear, jewelry, handbags, accessories, and intimate apparel.

Why is center core important?

JCPenney sees a $1 billion growth opportunity in its center core business over the next three years.

JCPenney’s center core categories are vital as they drive higher sales per square foot. They carry higher margin rates than the store average. Also, center core categories have been experiencing higher growth in the industry than the apparel business. However, JCPenney has seen deeper declines in certain center core categories, like footwear and handbags, than in apparel. This makes it even more important to focus on the growth of these categories. Also, center core offers great cross-selling opportunities.

Key initiatives

The company has been attracting more consumers by bringing fashion and style to its center core section. JCPenney’s Sephora store-within-a-store business is the pillar of its center core strategy. This will be discussed in the next part of this series.

Footwear

JCPenney sees tremendous growth in the footwear category, where it has a low market share compared to its competitors. According to the company, of the average female customer who purchases apparel in the JCPenney stores, only 21% purchase shoes. In fiscal 2014, JCPenney derived 8% of its net sales from footwear. The category accounted for 9% and 23% of the net sales of Kohl’s (KSS) and Nordstrom (JWN), respectively, in fiscal 2014. JCPenney and Kohl’s together account for 0.1% of the portfolio holdings of the iShares Russell 1000 Value ETF (IWD) and 0.4% of the Vanguard Consumer Discretionary ETF (VCR).

JCPenney has been working on separating women’s and men’s shoes display. The company has expanded its women’s shoe department with a combination of “sit-and-fit” and “open-sell” environments. Also, the men’s shoes section has been moved to the men’s department in an open-sell environment.

Other center core categories

Fine jewelry is a big ticket business, and JCPenney enjoys a strong market share in this category. In August 2014, the company launched Modern Bride Diamond Vault, an initiative that gives customers an opportunity to design their own jewelry.

JCPenney has low market shares in fashion jewelry, accessories, and handbags. The company has been creating an attractive environment for the display of these products in its stores. JCPenney also sees opportunity in the Sunglasses category, which is a high sales-per-square-foot business.

JCPenney has also been introducing attractive merchandise in the above-mentioned center core categories to increase store traffic.