Japanese and European Equities Offer Relative Value

A Janus Capital (JNS) report for 2015 outlook by Bill Gross stated, “We like Japanese and European equities due to cheap valuations and monetary boosters.”

Oct. 30 2015, Published 11:50 a.m. ET

US equity seems to offer less bang for the buck

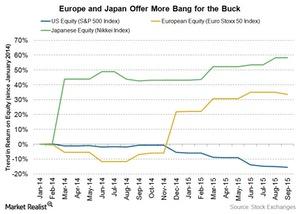

We’ve looked at what the price trend in US equity appears vis-à-vis Japanese and European equity. Let’s now see what the returns story has to say. While US equity seems to offer less bang (return) for the buck (price), European and Japanese equities tell a different story. Take a look at the graph below.

ROE for Europe and Japan has been rising

The return-on-equity (or ROE) trends for European equity, as measured by the Euro Stoxx 50 Index ROE, and for Japanese equity, as measured by the Nikkei Index, have demonstrated a clear rising trend so far this year. The return on US equity, as measured by the S&P 500 Index, on the other hand, has been dipping.

The SPDR EURO STOXX 50 ETF (FEZ), which tracks the Euro Stoxx 50 Index, gives exposure to European equity. The iShares MSCI Japan ETF (EWJ) and the WisdomTree Japan Hedged Equity ETF (DXJ) track Japanese equity.

Weak earnings growth has restricted US ROE

The decline in ROE in US equity can be partly explained by weak earnings growth in the United States. The global slowdown and the currency war have also been impacting returns and margins for US multinationals, pushing ROE down. Even the buyback spree, which many companies have gotten into in order to artificially inflate asset prices, hasn’t provided any recourse to the downtrend in ROE.

While earnings in the United States remain weak, there are other developed markets (EFA) where growth appears to be stronger. A Janus Capital (JNS) report for 2015 outlook by Bill Gross stated, “We like Japanese and European equities due to cheap valuations and monetary boosters.”

Quantitative easing has benefited companies in Europe and Japan

Companies in both Europe and Japan have been benefiting from the quantitative easing programs in these economies. The domestic economies are getting a boost from the cheaper credit-induced investments, while exports have been benefiting from the cheaper euro and yen. Unlike the United States, where the strengthening dollar has been eroding export revenues, cheaper currencies in these countries have been benefiting exporters and multinational firms to a great extent.

Companies such as GlaxoSmithKline (GSK) and Vodafone (VOD) from the Eurozone and Nomura (NMR) from Japan have delivered a whopping 164.2%, 89.5%, and 8.6% ROE.

Let’s delve a little more into what Europe has to offer.