Janus Capital Group Inc

Latest Janus Capital Group Inc News and Updates

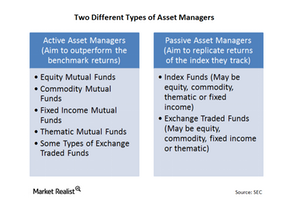

Traditional assets: Defining active and passive management

Active asset management refers to those asset managers that essentially try to outperform the average market return, a benchmark, or a hurdle rate that may have been set internally.

The salient features of mutual funds

There are investors who are willing to take on higher risk to generate above-average market returns. For these investors, active funds offer the optimal investment avenue.

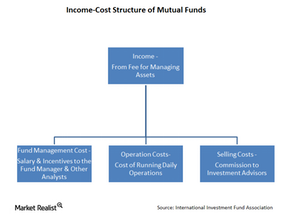

Show it: How mutual funds make money

In return for investing a client’s money, mutual funds charge a fee, generally an annual fee set as a percentage of the client’s assets. This fee is the only source of income for a mutual fund-focused asset manager.

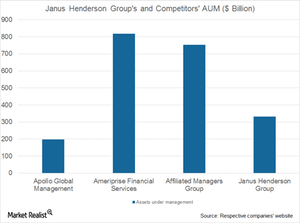

Janus-Henderson Merger: The Wait Is Over

The merger of Janus Capital Group (JNS) and Henderson Group (HGG), announced in late 2016, was finalized on May 30, 2017. It’s said to be a merger of equals.