Nomura Holdings Inc

Latest Nomura Holdings Inc News and Updates

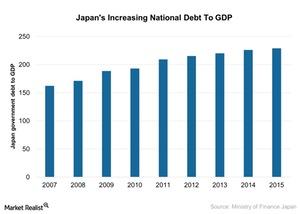

How Japan’s Fiscal Policies Can Help Achieve Its Economic Goals

Prime Minister Abe’s administration initially achieved coordination between the Bank of Japan’s QQE and fiscal stimulus.

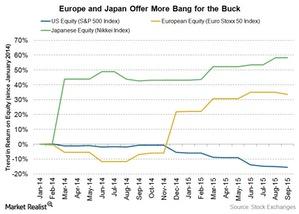

Japanese and European Equities Offer Relative Value

A Janus Capital (JNS) report for 2015 outlook by Bill Gross stated, “We like Japanese and European equities due to cheap valuations and monetary boosters.”