Why Growth in Gold Production Is Important for Gold Miners

Future gold production growth is important because the gold market is forward-looking, making future gold production a key driver of gold miners’ revenue.

Oct. 30 2015, Updated 9:11 a.m. ET

Gold production guidance for 2015

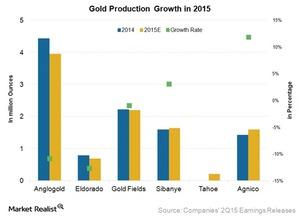

Future gold production growth is important because the gold market is forward-looking, making future gold production a key driver of gold miners’ revenue. In 2015, Eldorado Gold Corporation (EGO), for example, increased its gold production guidance to the higher end of its previous guidance range, whereas Anglogold Ashanti (AU) lowered its production guidance slightly. Agnico Eagle Mines (AEM), Sibanye Gold (SBGL), Gold Fields (GFI), and Tahoe Resources (TAHO) reaffirmed their gold production guidance.

Production increases and decreases

Eldorado Gold increased its gold production guidance for 2015 to the higher end of its previous guidance range of 640,000–700,000 ounces, driven by strength in the first half of 2015 and a higher capex. The company now expects gold production of 690,000 ounces for fiscal 2015.

Anglogold lowered its gold production guidance for 2015 from 4.0–4.3 million ounces to 3.8–4.1 million ounces due to an asset sale. The company sold its CC&V (Cripple Creek & Victor) mine in the US to Newmont Mining Corporation (NEM) for $820 million to reduce its debt level from the cash proceeds.

Reaffirmations of previous guidance

Agnico Eagle maintained its previous 2015 guidance of gold production of 1.6 million ounces. The company expects steady production in 2H15 as it has introduced various measures to improve productivity and cost structure.

Gold Fields also reaffirmed its 2015 gold production guidance at 2.2 million ounces. The lower gold production from its South Deep mine in South Africa is expected to be offset by better performance at its Granny Smith, Tarkwa, and Cerro Corona mines.

Tahoe Resources likewise maintained its 2015 gold production guidance at 200–220 thousand ounces. This was primarily driven by its acquired Rio Alto mines. Meanwhile, Sibanye Gold maintained its 2015 gold production guidance at 1.6 million ounces. This was primarily driven by its acquired Cooke mine in South Africa. The company’s gold production loss due to load shedding should be offset by increased contributions from its acquired Cooke mine.

There are various ways to invest in gold, such as physically purchasing gold, investing directly in gold miners, and investing in gold ETFs. The gold-backed SPDR Gold Trust (GLD), for example, is a major ETF for investors looking for exposure to gold.

Continue to the next part of this series for an assessment of which intermediate gold mining companies have cost advantages in 2H15.