Is Freeport-McMoRan Doing Enough to Contain Its Costs?

In this part of ours series, we’ll explore the trend in Freeport-McMoRan’s unit production costs.

Oct. 26 2015, Published 3:25 p.m. ET

Unit costs

Commodity producers don’t have much control over commodity prices. When commodity prices start falling, high-cost producers become unprofitable much sooner than their peers that are placed better on the cost curve. Low-cost producers are able to tide over economic cycles better. It becomes prudent for commodity producers to control their unit production costs. In this part of ours series, we’ll explore the trend in Freeport-McMoRan’s unit production costs.

Together, Freeport-McMoRan and Newmont Mining (NEM) form ~4.6% of the Materials Select Sector SPDR ETF (XLB).

Copper costs rise

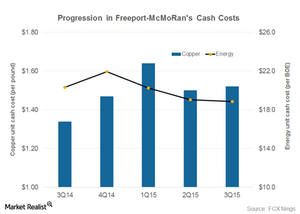

- Freeport-McMoRan’s unit copper cash costs after by-product credits were $1.52 in 3Q15. This represents a 13.4% year-over-year increase.

- In the energy business, Freeport-McMoRan’s consolidated unit cash costs fell to $18.85 per BOE (barrels of oil equivalent) from $20.32 per BOE a year ago. Freeport-McMoRan’s unit cash costs in its energy operations have been on a steady decline, as you can see in the graph above.

Falling copper prices have pressured copper producers to control their unit production costs. Copper producers, including Freeport-McMoRan (FCX) and Glencore (GLNCY), are cutting down on their high-cost capacity to tackle the low commodity price scenario. However, BHP Billiton (BHP) and Rio Tinto (RIO) aren’t looking at any major supply cuts.

Outlook

- Freeport-McMoRan expects unit copper cash costs of $1.52 in fiscal 2015. However, the company expects unit cash costs to fall to $1.15 next year.

- For energy, Freeport-McMoRan expects unit cash costs to average $19 in fiscal 2015.

In the next part of this series, we’ll explore how Freeport-McMoRan’s EBITDA (earnings before interest, taxes, depreciation, and amortization) played out in 3Q15.