Cliffs Natural Resources: 3Q15 Market Expectations

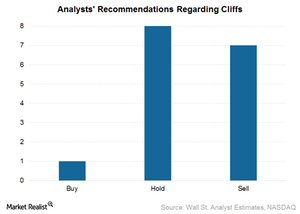

Market expectations for Cliffs Natural Resources (CLF) are varied. Of the analysts covering Cliffs, one has a “buy” recommendation, eight have a “hold,” and seven have a “sell.”

Oct. 19 2015, Updated 12:08 p.m. ET

Analyst recommendations

Market expectations for Cliffs Natural Resources (CLF) are varied. Of the analysts covering Cliffs, one analyst has a “buy” recommendation, eight have a “hold,” and seven have a “sell” for Cliffs stock. The average target price for Cliffs is $3.21.

Expectations from 3Q15

The analyst sales estimate for Cliffs (CLF) is $609.3 million for 3Q15. The estimate for adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) for 3Q15 is $73.7 million.

The current Wall Street analysts’ EPS (earnings per share) estimate for Cliffs in 3Q15 is a loss of $0.23 per share. Cliffs has delivered a results beat five out of the last eight times. Cliffs’s share price has reacted positively to the news of estimate beats.

Rating changes since 2Q15

In a note released on September 24, Macquarie Research reaffirmed its “buy” rating but reduced the target price from $7 to $6 per share due to changes in its iron ore price forecasts. FBR & Co. began coverage on Cliffs on September 18 with a “market perform” rating. Deutsche Bank also reduced its target price from $4.60 to $3 with a “hold” rating on October 5.

As far as market sentiment is concerned, Cliffs Natural Resources (CLF) seems to be on the receiving end. Most of it is due to the worsening current and future outlook for iron ore prices. This in turn is due to the supply glut by players such as BHP Billiton (BHP), Rio Tinto (RIO), Fortescue Metals Group (FSUGY), and Vale S.A. (VALE). These three stocks form 31.6% of the iShares MSCI Global Metals & Mining Producers ETF (PICK). The SPDR S&P Metals and Mining ETF (XME) also invests in this space.