Barrick: What Will Drive Increased Recoveries for Pueblo Viejo?

The Pueblo Viejo mine is a joint venture between Barrick Gold Corporation (ABX) at 60% and Goldcorp (GG) at 40%.

Nov. 3 2015, Updated 1:09 p.m. ET

Pueblo Viejo

The Pueblo Viejo mine is a joint venture between Barrick Gold Corporation (ABX) at 60% and Goldcorp (GG) at 40%.

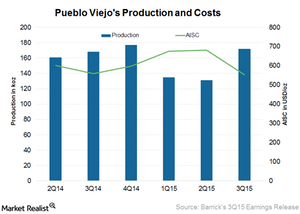

Barrick’s 60% share of production from Pueblo Viejo for 3Q15 was 172,000 ounces at all-in sustaining costs (or AISC) of $554 per ounce. Pueblo Viejo’s production was slightly below expectations mainly due to lower gold grades and recoveries. AISC was also negatively affected by lower silver recoveries due to scheduled autoclave maintenance, lime boil limitations, and unscheduled maintenance on the limestone grinding circuit.

Silver recoveries to improve

Management expects silver recoveries to improve going forward from 60% currently to 80%, owing to the addition of two lime boil tanks in November. The company’s guidance for Pueblo Viejo’s production is 625,000–675,000 ounces at an AISC of $540–$590 per ounce for 2015. This implies higher production at lower costs for 4Q15 due to higher grades and improved recoveries.

Streaming agreement

Recall from our previous report on Barrick Gold that the company had announced a gold and silver streaming agreement with Royal Gold (RGLD) on August 5.

The stream involves production linked to Barrick’s 60% interest in the Pueblo Viejo mine. Royal will pay cash upfront totaling $610 million plus make ongoing cash payments for gold and silver that’s delivered under the agreement. This agreement monetizes Pueblo Viejo’s value in a weak price environment. Increasing silver recoveries at Pueblo Viejo will be quite significant in this context, as under the streaming agreement, silver will be delivered based on a fixed recovery rate of 70%.

Royal Gold forms 5% of the VanEck Vectors Gold Miners ETF (GDX) while SPDR Gold Trust (GLD) provides exposure to physical gold prices.