Analyzing US and European Banks’ Leverage Ratios

On average, European banks have higher leverage than US banks. An excess buildup of leverage increases a bank’s exposure to the risk of bankruptcy.

Oct. 22 2015, Updated 2:04 p.m. ET

Understand leverage ratios

Leverage ratios are financial regulators’ favorite yardstick. The ratios measure the quality of a bank’s assets. Leverage ratios are defined as the proportion of a bank’s tier I capital ratio to its total risk-weighted assets. Basel III provides the internationally agreed standard, although a number of national authorities have opted for even stricter rules. The Basel III Capital Adequacy framework introduced a new ratio for controlling excess leverage. This measure expects banks to maintain a leverage ratio of at least 3% at all times.

Since the financial crisis of 2008–2009, there has been intense pressure on both US and European banks to raise capital levels to meet requirements. However, raising capital levels has been a burden for European banks because they witnessed another crisis in 2011.

European banks have higher leverage than their US counterparts

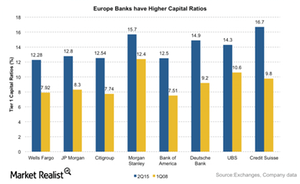

On average, European banks have higher leverage than their US counterparts. An excess buildup of leverage increases a bank’s exposure to the risk of bankruptcy. We saw this during the financial crisis of 2008. This makes European banks more vulnerable to downturns than US banks.

Banks like JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C) reported tier 1 capital ratios of 8.3%, 7.9%, and 7.7% in 1Q08. In comparison, European banks like Deutsche Bank (DB), RBS, and UBS reported tier 1 capital ratio of 8.6%, 7.3%, and 9.1%, respectively. However, it has improved since then to an average of 13.2% for US banks and 15.3% for European banks.

Investors seeking exposure to a portfolio of these banks could invest in the Financial Select Sector SPDR ETF (XLF) and the iShares MSCI Europe Financials ETF (EUFN). Banks account for ~50% of these ETFs.