Analyzing Coty’s Level of Competition

High-end companies like Coty rely on repeat customers and mainly compete on the basis of product quality and product differentiation.

Oct. 29 2015, Updated 1:05 a.m. ET

Intensity of competition

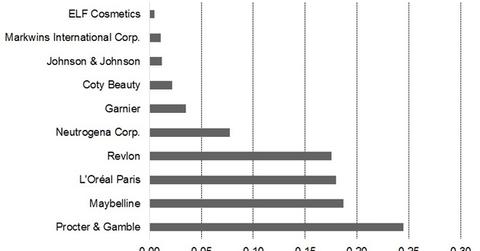

Coty Inc. (COTY) is a leading beauty and cosmetics company that competes with Estée Lauder (EL), L’Oréal (LRLCY), and Avon (AVP). According to an Ernst & Young report, the longer-term outlook remains positive for the beauty industry.

The report notes that global population that has access to cosmetics in emerging markets is estimated to increase by 50%. As a result, the beauty industry is expected to double in the next ten to 15 years in China, the US, Brazil, India, and Japan.

Threat of new entrants and substitutes

An increased number of own labels and the high buying power of large supermarkets enables the cost savings advantage for supermarkets. As the barriers to entry are low, new brands continue to be added to the industry and competition is tough.

Fragrances, skin care, and beauty products have a large number of substitutes. However, it is difficult to replace a product that has a well-regarded brand unless that replacement includes new technology that offers improved results. In addition, technology has made it easier to reverse engineer fragrances, boosting demand for cheaper imitation brands.

As a result, high-end companies like Coty rely on repeat customers and mainly compete on the basis of product quality and product differentiation.

Bargaining power of suppliers

Coty purchases raw materials (essential oils, alcohol, and specialty chemicals) for all products from a variety of third parties. The essential oils used in fragrances are generally sourced from fragrance houses.

The company works in collaboration with its suppliers to meet its stringent manufacturing requirements. This increases dependency on some suppliers, as there are no substitutes for some technical perfumeries.

Bargaining power of buyers

Coty’s distribution channels include Walmart (WMT), Target (TGT), and CVS, and the prestige distribution channels include Macy’s (M) and Sephora (LVMUY). Coty’s sales could be negatively affected with an adverse change in the customer base of any of these stores. Walmart is Coty’s largest customer, contributing to 7% of its total revenue in fiscal 2015. This increases the business risk for Coty, as it has limited control over the customer base or traffic trends of these stores.

Coty has exposure in the iShares Russell Mid-Cap Growth ETF (IWP) with ~0.1%[1. Updated as of October 2, 2015] of the total weight of the portfolio.