How Does UPS Benefit from Its Acquisition of Coyote Logistics?

United Parcel Services (UPS) announced its agreement to acquire Coyote Logistics. It’s a Chicago-based logistics firm with contract carrier companies.

Sept. 7 2015, Updated 9:07 a.m. ET

UPS acquires Coyote Logistics

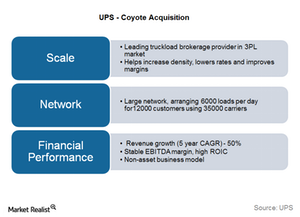

Recently, United Parcel Services (UPS) announced its agreement to acquire Coyote Logistics. It’s a Chicago-based logistics firm that has a network of about 35,000 contract carrier companies. It uses the contract carrier companies to help shipping companies with short-term trucking requirements. In recent years, Coyote has also designed a software that helped UPS meet holiday demands. The acquisition deal is said to be about $1.8 billion. UPS will complete the deal by using cash and debt resources.

The company would operate as a separate subsidiary. It’s expected to add to earnings as soon as 2016. The newly acquired company would add to UPS’s brokered full-truckload freight segment. The company expects that this segment will outpace other transportation segments in the future.

Benefits of adding Coyote

UPS suffered a big blow during the holiday season in 2013 when it failed to meet the service demands. Since then, the company has been very particular about handling its shipping performance during the holiday season. The acquisition is expected to help the company provide a more seamless supply chain during peak seasons as it will be armed with better technology.

Coyote has a strong market position across various types of customers from food and drink companies to retailers, paper and industrial firms, and industrial and retail segments. It also has vast industry knowledge, intellectual property, employee talent, and a strong company culture. This makes it a beneficial choice for UPS. It will enable UPS to have better fleet utilization. It’s expected to add up to $150 million in terms of revenue and savings. The company also expects to lower its empty leg trips by adding shipments.

UPS forms 7.60% of the iShares Transportation Average ETF (IYT). Similar companies included in the ETF are FedEx (FDX), Expeditors International (EXPD), and Con-way (CNW). They have 13.14%, 4.19%, and 3.19% holdings, respectively.