Why the Swiss Franc Is the Golden Currency

Recently, the safe haven currencies like the Swiss franc and the Japanese yen are the ones that are showing a greater correlation to gold.

Sept. 10 2015, Updated 12:14 p.m. ET

Switzerland and gold

The correlation that gold had with currencies in the period between July 6 and August 28, 2015, was a bit away from historical correlations. Gold producers like Australia, which had a strong historical correlation, saw the correlation slip below 0.3 in the period in study. Recently, the safe haven currencies like the Swiss franc and the Japanese yen are the ones that are showing a greater correlation to gold.

Whenever there is a crisis, investors try to move towards the safer assets. In the case of commodities, gold is a safe haven. In the case of currencies, the Swiss franc and the Japanese yen seem to be the safe haven. Another reason for the Swiss franc correlation would be that a large amount of the reserves in the Swiss National Bank (or SNB) are in the form of gold, so any major movement in gold will warrant a similar move in the Swiss franc too. It would be safe to say the correlation would have been higher if the proposed referendum to increase the percentage of gold in SNB’s total balance sheet from 10% to 20% had gone through in late 2014.

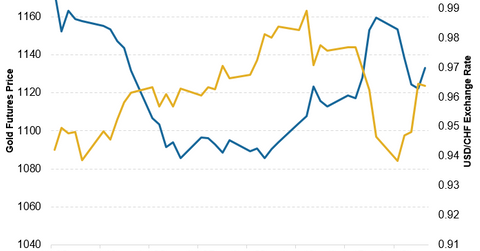

The Swiss franc is following gold futures

The above graph depicts the movement of gold December futures against the dollar to Swiss franc (or USD/CHF) pair for the eight weeks ending August 28, 2015. The graph depicts a negative correlation between USD/CHF and gold. The Swiss franc to gold December futures correlation was found to be strong at around 0.70 in the above-mentioned time period. While another safe haven currency, the Japanese yen was also found to have a decent correlation of 0.55 with gold futures in same time period.

Impact on the market

Swiss ETFs like the iShares MSCI Switzerland Capped ETF (EWL) fell by 2.51% in the period from July 6 to August 28. The SPDR Gold Shares ETF (GLD) followed a very similar trend, as it also fell down by 3.00% in the same period.

The Swiss banking ADRs (American depository receipts) were also on a negative trajectory with the Credit Suisse Group (CS) and the UBS Group (UBS) falling by 3.15% and 0.66% over the eight-week period ending August 28. The pharmaceutical company Novartis (NVS) was very volatile over the period, but eventually ended the period with only a slight fall of 0.27%.