iShares MSCI Switzerland ETF

Latest iShares MSCI Switzerland ETF News and Updates

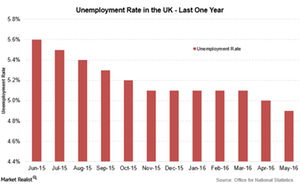

UK Unemployment Rate Improves, Brexit Concerns Remain

The unemployment rate in the United Kingdom reached 11-year low levels as the jobless rate fell to 4.9% for the period from March to May.

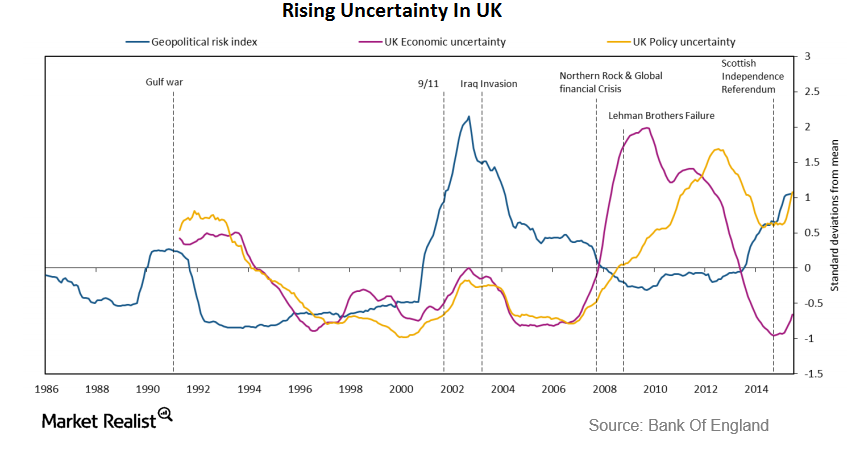

Pound Falls, BOE Summer Stimulus Hopes Rise after Carney’s Speech

On June 30, BOE (Bank of England) governor, Mark Carney, gave a speech signaling the BOE’s possible actions after the Brexit referendum on June 23.

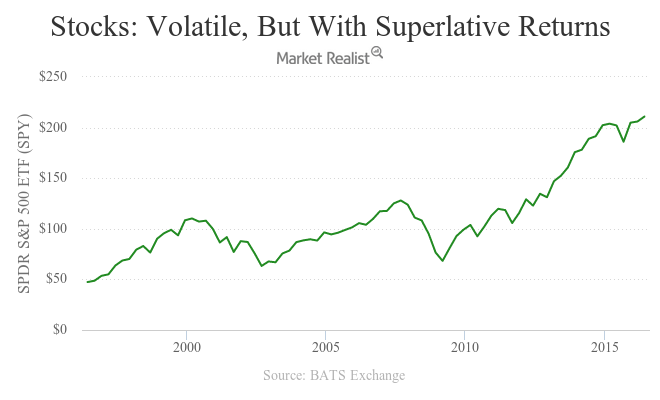

Why Bill Gross Thinks the Era of High Returns Is Over

Bill Gross thinks that the era of double-digit stock returns (SCHB) (USMV) and high single-digit investment-grade bond returns is over.

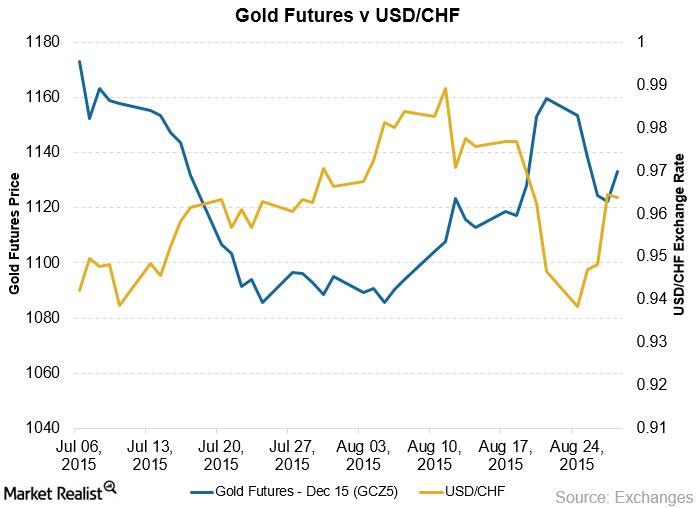

Why the Swiss Franc Is the Golden Currency

Recently, the safe haven currencies like the Swiss franc and the Japanese yen are the ones that are showing a greater correlation to gold.