Projected Synergies from an Anheuser-Busch InBev–SABMiller Deal

ABI is a leading company in the consumer staples sector. It has had a strong record of integrating acquisitions and delivering synergies ahead of target.

Oct. 2 2015, Updated 11:07 a.m. ET

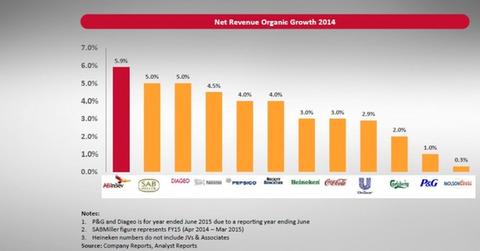

Anheuser-Busch InBev (BUD) (AHBIF) (ABI.BR), or ABI, faces a challenging environment in three of its largest markets—the US, Brazil, and China—but for different reasons. As we discussed in Part 5 of this series, ABI’s volumes in the US are down due to the rise of craft beer and to the higher consumption of wines and spirits.

By contrast, the economic environments in both Brazil and China have deteriorated. Acquiring SABMiller (SBMRY) (SAB.L) would give ABI an opportunity to grow its top-line, albeit through inorganic means.

Profitability enhancements

We should note here that ABI’s cost-cutting record has been phenomenal. The company is one of the most profitable companies in the consumer staples (XLP) (FXG) (VDC) sector. Not only has the company had a strong record of integrating its acquisitions, but it has also been delivering synergies ahead of target.

Synergies ahead of targets

The InBev acquisition of Anheuser-Busch had originally anticipated synergies of $1.5 billion within three years of the deal’s completion. But these initial estimates were exceeded by the combined companies reporting synergies of $2.25 billion by 2011. Most of these came via the new company’s zero-based budgeting initiatives, which saw the most results in the US and Canada. Its EBITDA (earnings before income, taxes, depreciation, and amortization) margins rose from 33.1% in 2008 to 38.7% by 2012.

Benefits from Grupo Modelo

ABI acquired Mexico’s largest beer company, Grupo Modelo, in a $25.6 billion deal (enterprise value net of disposals), in June 2013. The company anticipates synergies of $1 billion by 2016. ABI reported realized synergies of $730 million from the transaction by the end of 2014.

Transaction size

The SABMiller transaction would be much larger, however, with a transaction EV (enterprise value) likely over three times more than the Grupo Modelo deal. That compares to EVs of (as of September 22):

- $226.2 billion for ABI

- $32.4 billion for Constellation Brands (STZ) (STZ.B)

- $22.6 billion for Brown-Forman (BF.B)

- $18.2 billion for Molson Coors Brewing Company (TAP)

Molson Coors Brewing Company constitutes 0.8% of the portfolio holdings in the Consumer Staples Select Sector SPDR Fund (XLP).

Read the next part of this series for more on ABI’s debt levels and leverage.