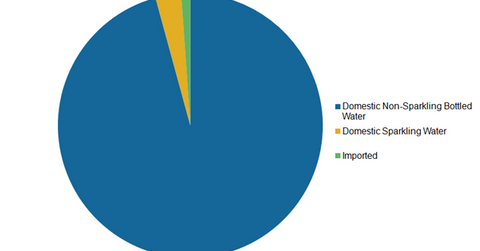

Non-Sparkling Water Is the Largest Bottled Water Segment in the US

The domestic non-sparkling bottled water category is the largest segment of bottled water in the US.

Nov. 20 2020, Updated 3:38 p.m. ET

Key categories

In Dr Pepper Snapple’s (DPS) second quarter conference call, Larry Young, the company’s president and CEO (chief executive officer), stated that the company is finally rolling out its popular Mexican Penafiel mineral water brand in Hispanic markets in the US. The Penafiel mineral water brand comes under the sparkling category of the bottled water market. The sparkling water category and the imported bottled water are subsegments of the US bottled water market, which is dominated by the non-sparkling category.

Non-sparkling bottled water

The domestic non-sparkling bottled water category is the largest segment of bottled water in the US. According to the Beverage Marketing Corporation, the non-sparkling bottled water category accounted for 95.8%, or 10.4 billion gallons, of the total bottled water volumes in 2014. The volume of this category grew by 7% in 2014. This category has four key segments:

- the retail premium segment, which comprises still water in single-serve polyethylene terephthalate (or PET) bottles

- direct delivery or HOD (home-and-office delivery)

- the retail segment, which includes larger bottle sizes with capacities of one to 2.5 gallons

- the vending segment

Premium PET dominates the industry

The premium PET is the largest segment of the non-sparkling bottled water category. The premium PET segment accounted for 66.5% of the total bottled water market volume. According to the Beverage Marketing Corporation, the PET segment has been growing at a double-digit rate since 2007.

PepsiCo’s (PEP) Aquafina, Coca-Cola’s (KO) Dasani, and Nestle’s (NSRGY) Pure Life and Poland Spring are some of the key non-sparkling brands with a major presence in the PET segment. PepsiCo and Coca-Cola together constitute 9.3% of the portfolio holdings of the iShares Global Consumer Staples ETF (KXI) and 0.85% of the iShares MSCI ACWI ETF (ACWI).

Other segments

The retail bulk and the direct delivery segments accounted for 9.5% and 11.8%, respectively, of the total US bottled water market volume in 2014. Though both these segments posted positive volume growth in 2014, their performance in recent times has been impacted by competition from the convenient and portable PET bottles. Even the low-cost vending segment, which performed well even during the recession, grew at a slower rate in 2014. The vending segment accounted for 7.9% of the total bottled market volume in 2014.

We’ll discuss the other two key categories of the US bottled water market in the next part of this series.