Nestle Continues to Dominate the US Bottled Water Industry

Nestle Waters North America is the market leader of the US bottled water industry.

Sept. 23 2015, Updated 3:13 a.m. ET

Industry ranking

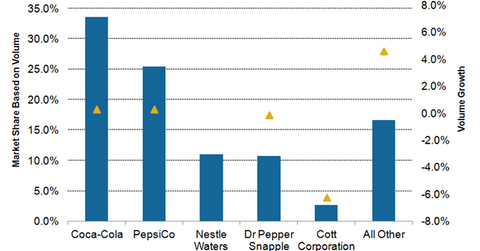

According to the data provided by Beverage Digest in March 2015, Nestle Waters, a business unit of Nestle (NSRGY), held the third largest market share of the US liquid refreshment beverage (or LRB) market, based on 2014 volume. The LRB market includes soda, energy drinks, sports drinks, bottled water, and other non-carbonated beverages.

Coca-Cola (KO), PepsiCo (PEP), and Dr Pepper Snapple (DPS) held the first, second, and fourth positions, respectively, of the US LRB market in 2014, based on volumes. Nestle Waters surpassed Dr Pepper Snapple with a volume growth of 9.1% to become the third largest LRB company in the US in 2014. This growth was driven by the strong demand for bottled water in the US. The Beverage Marketing Corporation anticipates bottled water to surpass the carbonated soft drink category of the LRB market by the end of this decade.

Nestle Waters’ extensive portfolio

An extensive brand portfolio and strong advertising are some of Nestle Waters’ strengths. Nestle Waters North America has an extensive portfolio of 15 bottled water brands. This includes sparkling water brands Perrier and San Pellegrino and still bottled water brands like Nestle Pure Life, Poland Spring, Deer Park, Arrowhead, and Ozarka.

According to Beverage Digest, Nestle Pure Life and Poland Spring brands outperformed top brands of the US LRB market like Coke, Pepsi, Mountain Dew, and Dr Pepper in 2014. Nestle Pure Life and Poland Spring brands posted volume growth of 8.9% and 7.9%, respectively, in 2014. The volumes of Coke and Pepsi brands declined by 2.4% and 2.9%, respectively, in 2014. Another bottled water brand that posted strong volume growth in 2014 was Coca-Cola’s Dasani bottled water. Dasani ranked among the top ten US LRB brands and posted 8.2% growth in its 2014 volumes.

Nestle Waters North America is the market leader of the US bottled water industry. Aside from PepsiCo’s Aquafina and Coca-Cola’s Dasani, Nestle also competes with the bottled water brands of private players like Crystal Geyser and Niagara. Nestle makes up 0.8% of the portfolio holdings of the Vanguard FTSE All-World ex-US ETF (VEU). Coca-Cola is the second largest component of the Consumer Staples Select Sector SPDR Fund (XLP), accounting for 9.1% of the fund.

In the last part of this series, we will discuss hurdles for the US bottled water industry.