Introducing Accenture, the Largest Global IT Consulting Firm in Revenues

Accenture is one of the world’s largest multinational technology services, management consulting, and outsourcing companies and is headquartered in Dublin.

Sept. 15 2015, Published 2:04 p.m. ET

Overview of the firm

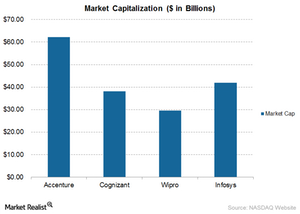

In this series, we’ll compare the performance of two IT (information technology) firms based in the United States—Accenture (ACN) and Cognizant Technology Solutions (CTSH)—with the performance of two Indian firms listed in the US, Wipro (WIT) and Infosys (INFY).

Accenture is a multinational technology services, management consulting, and outsourcing company founded in 1989 and headquartered in Dublin, Ireland. It’s one of the world’s largest consulting firms in terms of revenues, with a workforce of approximately 336,000 employees. In 2012, Accenture had more than of 80,000 employees in India, 40,000 in the United States, and 35,000 in the Philippines.

Cognizant is a leading provider of information technology, consulting, and business process services. Its clients include some of the world’s most prominent companies. Cognizant employs more than 220,000 people, and it has delivery centers in the United States, the United Kingdom, Canada, India, Hungary, China, the Philippines, Brazil, Mexico, and Argentina.

Infosys and Wipro heavyweights in India’s IT space

Wipro (WIT) is an IT consulting firm headquartered in Bangalore, India and has more than 158,00 employees. The firm was founded in 1945 and has a presence in 67 countries. Wipro has a market capitalization of $35 billion and is one of India’s largest publicly-traded companies.

Infosys (formerly Infosys Technologies) is an Indian multinational corporation that provides business consulting, information technology, software engineering, and outsourcing services. The firm was founded in 1981 and currently has a workforce of more than 180,000 employees.

To gain exposure to Accenture, you can invest in the Technology Select Sector SPDR Fund (XLK) and the Vanguard Information Technology ETF (VGT). The company’s stock accounts for 1.37% and 1.35% of the portfolios, respectively.

In the next part of this series, we’ll look with greater detail at these companies’ recent earnings.