Goldman Sachs’ Revenue Model

Goldman Sachs engages in asset management, investment banking, wealth management, institutional sales, and trading activities across asset classes as well as regions.

Sept. 20 2015, Updated 11:44 p.m. ET

Commission and fees

Goldman Sachs (GS) engages in asset management, investment banking, wealth management, institutional sales, and trading activities across asset classes as well as regions. In its investment banking division, the company charges fees, either fixed or as a percentage of the total transaction value, on the execution of transactions like fundraising activities, joint ventures, mergers and acquisitions, restructuring, and public offerings.

In its institutional client services division, Goldman Sachs generates commissions and fees from executing, clearing the transactions on major stock, options, and futures exchanges around the globe.

Management and other fees

Goldman Sachs charges asset-based fees on client assets. The company fees vary on the basis of asset class and investment performance as well as asset inflows and redemptions. It also receives financial counseling fees generated through the wealth advisory services and fees related to the administration of real estate assets.

Goldman Sachs is also entitled to performance fees on the funds managed through pooling or separately managed accounts. The fees form a certain percentage of returns generated over and above the hurdle rate.

Interest income

Goldman Sachs is also involved in commercial banking activities and records interest income and expenses, which are based on loans and deposits, commercial paper, and other loans and advances. It also depends on a mix of trading assets and trading liabilities.

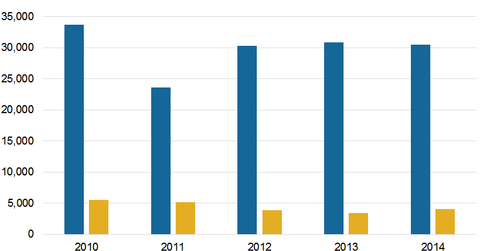

Goldman Sachs’ operating margins for the past 12 months stood at 30.8%. Here is how its peers compare:

- Morgan Stanley (MS): 9.5%

- JPMorgan Chase (JPM): 31.9%

- Bank of America (BAC): 8.1%

- Wells Fargo (WFC): 40.2%

Together, these banks account for approximately 28% of the Financial Select Sector SPDR ETF (XLF).