Gold Is Resilient to the Fed’s Likely Questionable Liftoff Move

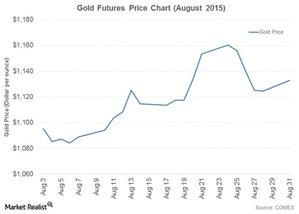

With the confusing reviews from the Fed on Wednesday, gold on COMEX rose 2.20% on August 20 and closed at $1,153.20 per ounce. Silver for September expiry also rose.

Sept. 8 2015, Updated 2:21 p.m. ET

FOMC meets on Wednesday

The FOMC (Federal Open Market Committee) meeting on Wednesday, August 19 was more subdued than hawkish. Investors were expecting a likely settlement on the decision of a rate hike, but that didn’t happen. A liftoff in the near term, say September, may have adverse effects on the precious metal lovers.

With the confusing reviews from the Fed on Wednesday, gold on COMEX rose 2.20% on August 20 and closed at $1,153.20 per ounce. Silver for September expiry also rose almost equivalent to gold and settled at $15.56 per ounce. In contrast, platinum rose ~2.10% and palladium rose 2.20%. The volumes for the precious metals were slightly higher than the previous trading day—August 19. The other precious metals, like platinum and palladium, are also following the herd.

The Fed’s minutes suggested that a confidence stratum should exist before the liftoff. The unfavourable economic indicators like the CPI (consumer price index), manufacturing sales, and consumer confidence will likely delay the rate hike. Although an approaching rate move is confirmed, when it occurs is the question. The overall outcome of the meeting wasn’t conclusive. It had wide-ranging opinions.

ETFs

The SPDR Gold Shares ETF (GLD) rose 1.70% on August 20 and closed at $110.44 per share. It has risen 3.71% in August. The volume has seen an upswing compared to the early days in August. Gold has risen during the month. The iShares Gold Trust ETF (IAU) rose 3.78% in a month.

The VanEck Vectors Gold Miners ETF (GDX) also saw a rise of 2.62% in a month. Member companies of the VanEck Vectors Gold Miners ETF (GDX), like Franco-Nevada (FNY), Agnico-Eagle Mines (AEM), Pan America Silver (PAAS), and First Majestic Silver (AG) also showed positive returns in August. Together, these companies account for ~9% of GDX.