Short-Term Outlook: Freeport-McMoRan, Copper Could Drift Lower

Although copper prices have recovered from sub-$5,000 levels, the worst doesn’t seem to be over for copper or Freeport-McMoRan (FCX).

Sept. 13 2015, Updated 12:22 p.m. ET

Copper prices

Although copper prices have recovered from sub-$5,000 levels, the worst doesn’t seem to be over for copper or Freeport-McMoRan (FCX). In this part of our series, we’ll explore where copper prices could he headed in the short term.

Currently, Freeport forms 2.13% of the Materials Select Sector SPDR ETF (XLB) and 0.74% of the iShares North American Natural Resources ETF (IGE).

Analyst estimates

Goldman Sachs now expects copper prices to reach $4,500 per ton, or approximately $2.04 per pound, by the end of 2016.

According to a Platts report citing a Thomson Reuters GFMS (Gold Field Mineral Survey), “Industry average net cash costs declined intra-year by 11% while the 90th percentile, measured at $4,763/mt, still gives the industry some space for further price decline.”

Copper prices could remain weak

Copper prices could remain weak for the remainder of 2015 as well. Analysts see copper prices as a reflection of the global economy. This is due to copper’s diverse end use. For that reason, copper has been dubbed “Doctor Copper.”

However, copper prices might actually be dubbed “Doctor China,” based on the way China dominates global copper markets.

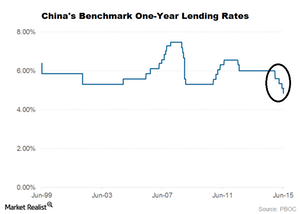

In the short term, news flow from China will most likely continue to impact copper prices. Though the Chinese government and Central Bank are trying to do everything possible to stem the economic downturn in the country, things only seem to be getting worse. China’s benchmark one-year lending rates are now at a historical low, as you can see in the chart above.

The slowdown in China will most likely continue to have an adverse effect on copper prices.

Earnings of copper producers, including Southern Copper (SCCO), Freeport-McMoRan, and Teck Resources (TCK), are sensitive to copper prices. These companies could experience more pressure if copper prices fall further.

In the next part of our series, we’ll analyze how production costs vary across different copper producers.