A Comparative Analysis of the Aluminum Industry

Aluminum is the second most widely used metal after steel. Investors have a special liking for aluminum. There are several ways to play the industry.

Sept. 20 2015, Updated 8:50 a.m. ET

The aluminum industry

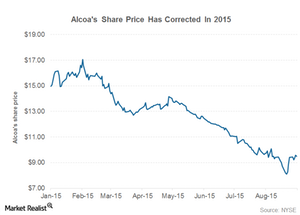

So far, base metals like aluminum, copper, and iron ore are having a tough year in 2015. Aluminum and copper prices are testing their six-year lows while iron ore touched its ten-year low earlier this year. Metals and mining companies’ share prices, including Vale SA (VALE) and Rio Tinto (RIO), are still trading weak—near their 52-week lows.

Moreover, looking at several macro challenges, the outlook doesn’t look any better. The slowdown in China is weighing heavily on commodity companies’ share prices.

However, commodity stocks have never been for the fainthearted. During upturns, commodity companies tend to outperform almost all other asset classes. Due to the natural law of gravity, these companies bear the brunt when economic activity takes a hit.

Series overview

In this series, we compare the major aluminum players. Alcoa is the largest aluminum producer in North America. It has been under severe pressure this year, as you can see in the above chart.

Currently, Alcoa (AA) forms 0.86% of the iShares North American Natural Resources ETF (IGE) and 1.44% of the SPDR S&P Global Natural Resources ETF (GNR).

Aluminum’s value chain

Aluminum is the second most widely used metal after steel. Investors have a special liking for aluminum. There are several ways that they can play the aluminum industry. There are listed aluminum producers, as well the option to directly participate in aluminum prices through the physical trading of the metal.

While the current downtrend in the aluminum industry is definite, there are several pockets within the aluminum value chain where investors can play the rising aluminum demand.

In the next part, we’ll analyze aluminum’s value chain.