Comp: Which Gold Miners Expect Production Growth Going Forward?

Yamana Gold (AUY) expects higher gold production in the second half of the year compared to the first half of the year. It’s expected to be more than 15% higher.

Sept. 29 2015, Updated 11:09 a.m. ET

Production growth

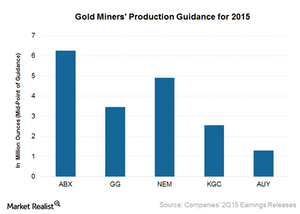

Newmont Mining (NEM) revised its production guidance upward. This was mainly to reflect its continuing strong performance and the impact of recent acquisitions. Newmont has revised its 2015 production guidance for gold from 4.6–4.9 million ounces to 4.7–5.1 million ounces. This was mainly to reflect the recent acquisitions including the Cripple Creek & Victor Gold Mine and the building of Long Canyon Phase 1. For 2017, management suggests a production range of 5.2–5.5 million ounces of gold.

Goldcorp (GG) expects production for 2015 to be at the high end of the previously guided 3.3–3.6 million ounces. The company also noted that the gold production for 2015 is expected to be weighted toward the second half of the year. This is due to the continuing ramp-ups of the Cerro Negro and Eleonore mines and the planned mine sequence at Peñasquito.

Lowered production guidance

Reflecting the sale of the Cowal mine and 50% of Barrick Nuigini, Barrick Gold (ABX) has reduced its 2015 gold production guidance to 6.1–6.4 million ounces from 6.2–6.6 million ounces. This production is 55% weighted toward the second half of the year because that’s when more production is planned to occur at the Goldstrike, Cortez, and Pueblo Viejo mines. Barrick’s production profile is going to be stable at best going forward. This is mainly due to non-core asset sales that it already made or is in the process of making.

Kinross Gold’s (KGC) production guidance for 2015 is 2.5–2.6 million gold equivalent ounces. Management expects to reach the high-end of this range. Kinross is one of the miners whose long-term production profile is falling. The company lacks growth potential. In order to maintain its production profile, it needs to either invest organically or acquire producing mines or junior miners with production potential.

Lack of operational consistency

Yamana Gold (AUY) expects higher gold production in the second half of the year compared to the first half of the year. It’s expected to be more than 15% higher. The market is concerned about Yamana being able to fulfill its guidance for 2015 given its past issues. Although its overall production profile is improving with its mines entering higher grade areas, Yamana is struggling to deliver a consistent set of operational results. That’s the biggest market concern for the stock.

The VanEck Vectors Gold Miners ETF (GDX) offers exposure to senior and intermediate gold miners. The SPDR Gold Trust (GLD) tracks spot gold prices. Barrick and Goldcorp account for 12.70% of GDX’s holdings.