An Analysis of Financial Leverage for Dry Bulk Companies

Scorpio Bulkers (SALT) has the lowest financial leverage with debt-to-assets of 31.8% and debt-to-equity of 42.6% as of September 30, 2015. But this doesn’t give the full picture.

Jan. 5 2016, Updated 8:06 a.m. ET

Leverage ratios

Investors in the shipping industry need to know a company’s debt levels. It’s such a capital-intensive industry that high levels of debt can put a strain on a company’s credit ratings. High debt levels can also weaken a company’s ability to purchase new equipment or finance other capital projects. This is especially true in a falling freight rate market environment such as now.

In an industry downturn, companies with higher leverage usually underperform. Those companies also have higher chances of going bankrupt. However, in good times, high leverage can be positive, as it magnifies the earnings. Also, a company’s ability to raise debt is important for investors to watch, as it can help a company grow. In bad times, when a company’s debt-paying ability comes under pressure, it might have to take extreme measures such as selling vessels and reducing returns to shareholders to improve leverage.

Low financial leverage

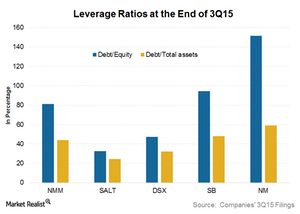

As the above chart shows, Scorpio Bulkers (SALT) has the lowest financial leverage with debt-to-assets of 31.8% and debt-to-equity of 42.6% as of September 30, 2015. This ratio, however, doesn’t give the full picture, as SALT has a massive newbuilding pipeline with 34 dry bulk vessels yet to be delivered and $645.7 million unpaid on them. The company will have to draw down debt going forward to pay for this, which will escalate its leverage.

Diana Shipping (DSX) also has low financial leverage, with debt-to-assets of 32.1%. Companies with the strongest balance sheet can weather the weakness for a longer time than their highly leveraged peers.

Navios Maritime Partners (NMM) has debt-to-equity and debt-to-assets ratios of 81.3 and 41.8, respectively.

Companies with high leverage

In the dry bulk shipping space (SEA), Navios Maritime Holdings (NM) and Safe Bulkers (SB) are more leveraged than their peers.

Navios Maritime Holdings (NM) has 2% holdings in SEA. The SPDR S&P 500 ETF (SPY) represents the broader transportation industry.

If the dry bulk shipping industry does recover, companies with higher leverage ratios can generally outperform those with a lower leverage.

In the next article, we’ll look more deeply into dry bulk companies’ cash holdings and their near- and long-term needs to see if they can survive the current downturn.