Amgen’s Presence in the Biosimilar Market

As it is still relatively difficult to introduce biosimilars, Amgen plans to enter the US market by leveraging experience of biosimilars in the European market.

Sept. 15 2015, Updated 11:06 a.m. ET

Biosimilar market

Frost & Sullivan projects that the global biosimilar market will reach $23 billion in revenue by 2019. With technology and the high complexity of original drugs as potential entry barriers to generic drug development, biosimilar companies are expected to witness low competition and therefore better profitability. Hence, Amgen (AMGN) has chosen this fast-growing market.

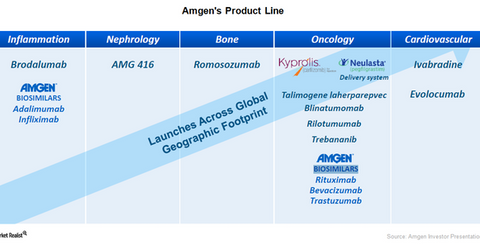

The above graph shows that Amgen has five biosimilar programs across the fields of inflammation and oncology, while one biosimilar cetuximab was later added to the company’s pipeline. According to the Food and Drug Administration, or FDA, “Biosimilars are a type of biological product that is licensed (approved) by the FDA because they are highly similar to an already FDA-approved biological product, known as the biological reference product (reference product), and have been shown to have no clinically meaningful differences from the reference product.”

Market entry strategy

In April 2015, FDA finalized the guidance documents listing its expectations for biosimilar drugs. As it is still relatively difficult to introduce biosimilars, Amgen plans to enter the US market by leveraging experience of biosimilars in the European market. The company expects to launch these drugs first in 2017 and to release about five drugs by 2019. Additionally, three biosimilar programs were announced in 2014. Biosimilars account for an opportunity of about $3 billion in revenue for Amgen.

Oncology and inflammation

Amgen has entered into collaboration with Actavis, now called Allergan (ACT), to develop four oncology biosimilars. The company is developing bevacizumab, a biosimilar for Roche’s (RHHBY) Avastin, targeting non-small cell lung cancer, or NSCLC, and trastuzumab, a biosimilar for Genentech’s Herceptin for breast cancer. Additionally, Amgen’s oncology portfolio includes cetuximab, a biosimilar for Merck’s Erbitux treating metastatic colorectal cancer, and rituximab, a biosimilar for Biogen and Genentech’s Rituxan.

Amgen’s inflammation portfolio involves adalimumab, a biosimilar for AbbVie’s (ABBV) blockbuster drug Humira, targeting psoriasis and rheumatoid arthritis, and infliximab, a biosimilar for Janssen’s Remicade. To learn more about Humira, please refer to “Humira Takes Top Spot for Rheumatoid Arthritis Drugs.”

Investors can get diversified exposure to Amgen’s biosimilar strategy, yet avoid unique company risks, by investing in the iShares NASDAQ Biotechnology ETF (IBB). IBB has 8.53% of its total holdings in Amgen.