Natural Gas Inventories Beat Expectations: How Will Prices React?

On Thursday, August 13, the EIA (U.S. Energy Information Administration) published its “Natural Gas Weekly Update” for the week ended August 7.

Aug. 17 2015, Published 2:02 p.m. ET

Natural gas inventories

On Thursday, August 13, the EIA (U.S. Energy Information Administration) published its “Natural Gas Weekly Update” for the week ended August 7. The report shows that the natural gas storage increase was 65 Bcf (billion cubic feet), causing inventories to rise to 2,977 Bcf that week. Analysts had been expecting a smaller increase of 56 Bcf.

What this means for investors

When inventories rise more than the market expects, it’s usually bearish for natural gas prices. It either means that demand is less than expected or that supply is greater than expected.

Lower natural gas prices mean lower revenues for natural gas producers such as Chesapeake Energy (CHK), Southwestern Energy (SWN), QEP Resources (QEP), and Cabot Oil & Gas (COG). These companies earn less money when natural gas prices fall and more money when prices rise. All of these companies combined make up 1.6% of the iShares U.S. Energy ETF (IYE).

Lower natural gas prices may also negatively affect MLPs such as ONEOK Partners (OKS). Lower prices may encourage producers to produce less natural gas, which would mean less volume for MLPs to transport.

Weekly data

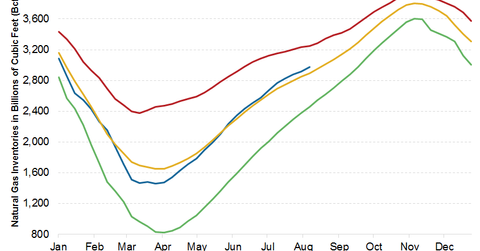

The 65 Bcf net injection in the week ended August 7 compares to a net injection of 79 Bcf in the corresponding week last year and a five-year average net injection of 48 Bcf.

According to the EIA, from the week ended April 3, the beginning of the injection season, through the week ended August 7, net injections totaled 1,516 Bcf. In comparison, 1,623 Bcf were injected in the corresponding 19 weeks last year. The five-year average injection for the corresponding 19 weeks is 1,245 Bcf.

Current inventories

After the 65 Bcf build in the week ended August 7, natural gas inventories were ~22% higher than last year’s levels and 2.8% higher than the five-year average. Inventories have been outpacing the five-year average since the week ended May 29. This is bearish for natural gas prices, and it adds to the bearishness of the more-than-expected inventory increase.

The following part of this series discusses how markets reacted to this news.

Forecasts

The EIA’s August STEO (“Short-Term Energy Outlook”) report, released on August 11, forecasts that inventories will total 3,867 Bcf at the end of the injection season in October. That would be 61 Bcf, or 1.6%, higher than the five-year average.