Why Japanese Stock Valuations Could Be Justified

Japan looks cheap compared to other developed markets. Japanese stock valuations can be justified if the “three arrows” are used prudently.

March 2 2015, Updated 1:06 p.m. ET

Corporate reforms should now continue

We’ve been bullish on Japanese stocks for some months, and the LDP’s win only strengthens our case. Despite a run-up in price this fall, we think Japan remains a relative bargain in the developed markets (EFA).

Of course, cheapness can also result in a value trap without a catalyst to turn things around. We see three such catalysts, essentially corresponding to the three arrows in the Abenomics quiver. We’ve seen the first two already at work in the form of unprecedented monetary easing by the Bank of Japan – one of the few major central banks still injecting liquidity – and a flexible fiscal policy via government spending.

Market Realist – Japan looks cheap compared to other developed markets.

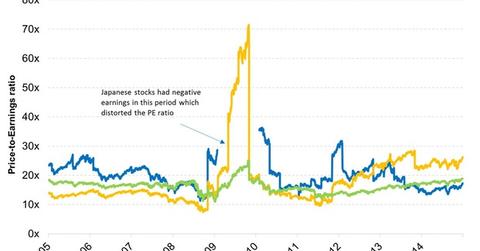

The graph above compares the PE ratio (price-to-earnings ratio) of Japanese stocks (EWJ), as tracked by Topix, with the PE ratio of European stocks (EZU), as tracked by Euro Stoxx, and with the S&P 500 Index (SPY)(IVV). The PE ratios for the three are 17.3x, 26.3x, and 18.9x, respectively.

European stocks in particular appear expensive, especially given the state of Europe’s economy. Perhaps the reason why European stock valuations appear lofty is that the ECB (European Central Bank) is injecting liquidity into the markets, which is creating a stock bubble there.

While the BoJ (Bank of Japan) is also injecting liquidity–which is the first of the three arrows–TOPIX is appearing relatively cheap. The PE ratio is now trading below its ten-year average in Japan. Meanwhile, back home, the stock markets have recently been driven up by robust earnings and not multiple expansion.

Market Realist – Japanese stock valuations can be justified if the “three arrows” are used prudently.

A government can stimulate the economy by either cutting taxes or spending more. The graph above shows the government spending in Japan since 2011. The second arrow in Abenomics is fiscal stimulus, which includes spending. However, the growth in spending has been muted in the last few quarters mainly due to Japan’s burgeoning debt. If revenues—mainly collected through taxes—are less than government spending, the government has to issue debt. This is one of the reasons why Japan raised consumption taxes last year.

The final arrow in Abe’s quiver is structural reforms. These are mainly what could turn around Japan’s fortunes. More on this later.